New York, USA, March 05, 2025 (GLOBE NEWSWIRE) -- Essential Thrombocythemia Market to Witness Upsurge in Growth During the Study Period (2020–2034) | DelveInsight

The essential thrombocythemia market is expected to grow steadily due to increasing disease prevalence, advancements in targeted therapies, and rising awareness. The development of JAK inhibitors and other novel treatments is driving market expansion. Additionally, improved diagnostic techniques and supportive regulatory frameworks are fostering growth. However, challenges such as high treatment costs and limited patient populations may impact the market trajectory.

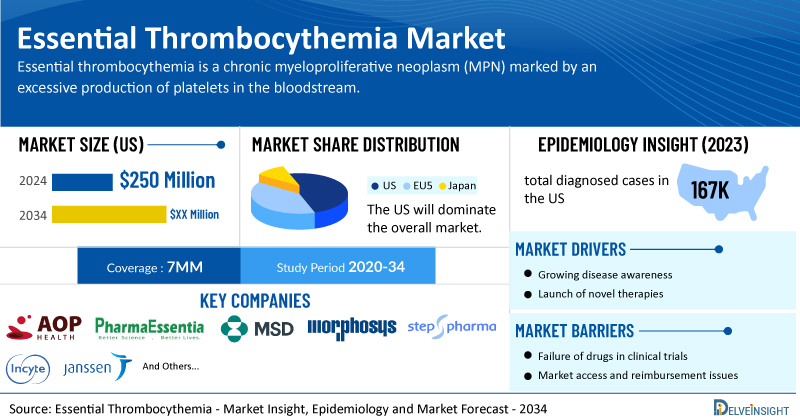

DelveInsight’s Essential Thrombocythemia Market Insights report includes a comprehensive understanding of current treatment practices, emerging essential thrombocythemia drugs, market share of individual therapies, and current and forecasted essential thrombocythemia market size from 2020 to 2034, segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the Essential Thrombocythemia Market Report

- According to DelveInsight’s analysis, the market size of essential thrombocythemia in the US reached USD 250 million in 2024 and is expected to increase by 2034.

- By 2034, among the emerging therapies, the highest revenue is expected to be generated by BESREMi.

- The total diagnosed cases of essential thrombocythemia in the US were around 167K cases in 2024.

- Prominent companies working in the domain of essential thrombocythemia, including AOP Orphan Pharmaceuticals AG, PharmaEssentia, Merck Sharp and Dohme, MorphoSys, Step Pharma, Incyte Corporation, Janssen Research & Development, and others, are actively working on innovative essential thrombocythemia drugs. These novel essential thrombocythemia therapies are anticipated to enter the essential thrombocythemia market in the forecast period and are expected to change the market.

- Some of the key essential thrombocythemia treatments include BESREMi (ropeginterferon alfa-2b/P1101), Bomedemstat (MK-3543/IMG-7289), Pelabresib (CPI-0610), Dencatistat (STP 938), INCA033989, VAC85135, and others.

- In August 2024, pharmaand GmbH (pharma&) announced that the EC had granted marketing authorization for a Type II variation for PEGASYS (peginterferon alfa-2a) as a monotherapy treatment for adults with ET.

Discover which therapies are expected to grab the essential thrombocythemia market share @ Essential Thrombocythemia Market Report

Essential Thrombocythemia Overview

Essential thrombocythemia is a chronic myeloproliferative neoplasm (MPN) marked by an excessive production of platelets in the bloodstream. It is most frequently diagnosed in women over the age of 50. The condition arises due to mutations in the JAK2, CALR, or MPL genes, which drive the overproduction of hematopoietic cells and contribute to the development of MPN. While these mutations are found in approximately 90% of affected adults, some children may present with a triple wild-type status, meaning they lack these genetic alterations.

Many individuals with essential thrombocythemia experience no symptoms, and the disease is often detected incidentally during routine blood tests that reveal an elevated platelet count. When symptoms do occur, they can include fatigue or complications associated with abnormal blood vessel function, such as clotting or bleeding. The median life expectancy for essential thrombocythemia patients is around 20 years, though this varies based on age at diagnosis. Those diagnosed before the age of 60 have a median survival of approximately 33 years. The primary health risk associated with essential thrombocythemia is thrombosis, which affects 20% of patients, while bleeding complications occur in about 10% of cases.

Essential Thrombocythemia Epidemiology Segmentation

The essential thrombocythemia epidemiology section provides insights into the historical and current essential thrombocythemia patient pool and forecasted trends for the 7MM. It helps recognize the causes of current and forecasted patient trends by exploring numerous studies and views of key opinion leaders.

The essential thrombocythemia market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Diagnosed Prevalent Cases

- Symptom-specific Cases

- Gender-specific Cases

- Mutation-specific Cases

- Risk-specific Cases

- Age-specific Cases

- Total Treated Cases

Download the report to understand which factors are driving essential thrombocythemia epidemiology trends @ Essential Thrombocythemia Epidemiological Insights

Essential Thrombocythemia Treatment Market

Given the current market landscape, the treatment of essential thrombocythemia primarily aims to reduce the risk of blood clots and manage symptoms through a range of therapeutic options based on individual risk levels. Aspirin is widely recommended for low, intermediate, and high-risk patients due to its role in preventing clot formation. First-line therapy typically involves aspirin in combination with cytoreductive treatments such as hydroxyurea, anagrelide, and interferon-alpha, which help lower platelet counts and minimize complications.

Additionally, cytoreductive therapy is used to reduce the risk of bleeding in patients with platelet counts exceeding 1 million/µL. In some cases, medications like busulfan, clopidogrel, and anticoagulants may be prescribed, depending on the patient's response to treatment. Continuous monitoring is essential to adjust therapy and mitigate risks.

Currently, only one drug has been approved specifically for the treatment of essential thrombocythemia, and it is authorized solely in Europe. In contrast, no FDA-approved therapies exist for essential thrombocythemia treatment in the United States.

PEGASYS, a Type I interferon, is derived from interferon alfa-2a through a pegylation process, where one or more polyethylene glycol (PEG) chains are attached to the molecule. Previously, PEGASYS was approved by the European Commission (EC) for treating Chronic Hepatitis B (CHB) in adults and children aged three and older, as well as Chronic Hepatitis C (CHC) in adults and children aged five and older—either in combination with other medications for adults or with ribavirin for children.

In August 2024, pharma& announced that the EC had granted marketing authorization for a Type II variation of PEGASYS (peginterferon alfa-2a), allowing its use as a monotherapy for adults with essential thrombocythemia.

Learn more about the market of essential thrombocythemia @ Essential Thrombocythemia Treatment

Essential Thrombocythemia Emerging Drugs and Companies

Beyond PEGASYS, the treatment landscape for essential thrombocythemia is evolving, with several promising assets in the pipeline. These include BESREMi (ropeginterferon alfa-2b), Bomedemstat (MK-3543/IMG-7289), Pelabresib (CPI-0610), Dencatistat (STP 938), INCA033989, and VAC85135, among others.

Ropeginterferon alfa-2b is an innovative, site-specific, monopegylated, and stable IFN-a analog. Unlike earlier generations of polypegylated interferons, which underwent random pegylation and resulted in multiple isoforms with varying activity and stability, ropeginterferon alfa-2b is distinguished by its unique single isoform.

PharmaEssentia conducts clinical trials to evaluate the efficacy and safety of ropeginterferon alfa-2b, while AOP Orphan frequently collaborates in the European market for regulatory approvals and distribution. Currently, ropeginterferon alfa-2b is FDA-approved for treating polycythemia vera. The company intends to engage with the FDA to expand its label to include essential thrombocythemia, with plans for regulatory submission by the end of 2025.

Bomedemstat (MK-3543) is an experimental, irreversible small-molecule inhibitor of LSD1, currently being developed by Merck. LSD1 plays a crucial role in regulating the proliferation, differentiation, and maturation of hematopoietic stem cells. The drug is under investigation for various myeloproliferative neoplasms (MPNs), including essential thrombocythemia, myelofibrosis, and polycythemia vera.

Bomedemstat has received multiple regulatory designations, including Orphan Drug Designation (ODD) and Fast Track Designation (FTD) for essential thrombocythemia and myelofibrosis, as well as ODD for acute myeloid leukemia. Additionally, it has been recognized under the European Medicines Agency’s Priority Medicines (PRIME) scheme for MF. In December 2023, Merck presented updated findings from the Phase IIb Shorespan-003 trial, including the first-ever genomic data, at the American Society of Hematology (ASH) Annual Meeting.

The anticipated launch of these emerging therapies are poised to transform the essential thrombocythemia market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the essential thrombocythemia market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about essential thrombocythemia clinical trials, visit @ Essential Thrombocythemia Treatment Drugs

Essential Thrombocythemia Market Dynamics

The essential thrombocythemia market dynamics are anticipated to change in the coming years. The essential thrombocythemia market is driven by several key factors, including the increasing prevalence of myeloproliferative disorders, advancements in diagnostic techniques, and the growing adoption of targeted therapies. Rising awareness among healthcare professionals and patients about early diagnosis and treatment options has further fueled market growth.

Additionally, the development of novel JAK inhibitors and other targeted therapies, along with ongoing clinical trials exploring innovative treatment approaches, is expanding the therapeutic landscape. Supportive regulatory policies, improved healthcare infrastructure, and rising healthcare expenditure in emerging markets also contribute to the market's expansion. Moreover, strategic collaborations and investments by pharmaceutical companies in R&D are accelerating drug development, enhancing treatment efficacy, and driving market growth.

Furthermore, many potential therapies are being investigated for the treatment of essential thrombocythemia, and it is safe to predict that the treatment space will significantly impact the essential thrombocythemia market during the forecast period. Moreover, the anticipated introduction of emerging therapies with improved efficacy and a further improvement in the diagnosis rate is expected to drive the growth of the essential thrombocythemia market in the 7MM.

However, several factors may impede the growth of the essential thrombocythemia market. One major challenge is the limited patient population, as essential thrombocythemia is a rare myeloproliferative neoplasm, making it less attractive for large pharmaceutical investments. essential thrombocythemia further complicate drug approvals, with essential thrombocythemia for safety and efficacy due to the chronic nature of the disease.

Additionally, the market is dominated by the off-label use of existing treatments, such as hydroxyurea and interferon, reducing the urgency for novel therapies. High development costs, reimbursement challenges, and a lack of widespread awareness among healthcare providers and patients also contribute to slow market penetration for innovative drugs.

Moreover, essential thrombocythemia treatment poses a significant economic burden and disrupts patients’ overall well-being and QOL. Furthermore, the essential thrombocythemia market growth may be offset by failures and discontinuation of emerging therapies, unaffordable pricing, market access and reimbursement issues, and a shortage of healthcare specialists. In addition, the undiagnosed, unreported cases and the unawareness about the disease may also impact the essential thrombocythemia market growth.

| Essential Thrombocythemia Report Metrics | Details |

| Study Period | 2020–2034 |

| Essential Thrombocythemia Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Essential Thrombocythemia Market Size in 2024 | USD 250 Million |

| Key Essential Thrombocythemia Companies | AOP Orphan Pharmaceuticals AG, PharmaEssentia, Merck Sharp and Dohme, MorphoSys, Step Pharma, Incyte Corporation, Janssen Research & Development, pharma&, and others |

| Key Essential Thrombocythemia Therapies | BESREMi (ropeginterferon alfa-2b/P1101), Bomedemstat (MK-3543/IMG-7289), Pelabresib (CPI-0610), Dencatistat (STP 938), INCA033989, VAC85135, PEGASYS (peginterferon alfa-2a), and others |

Scope of the Essential Thrombocythemia Market Report

- Essential Thrombocythemia Therapeutic Assessment: Essential Thrombocythemia current marketed and emerging therapies

- Essential Thrombocythemia Market Dynamics: Conjoint Analysis of Emerging Essential Thrombocythemia Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, Pricing Analysis, Market Access and Reimbursement

Discover more about essential thrombocythemia in development @ Essential Thrombocythemia Clinical Trials

Table of Contents

| 1 | Key Insights |

| 2 | Report Introduction |

| 3 | Essential Thrombocythemia Market Overview at a Glance |

| 3.1 | Market Share (%) Distribution of ET in 2024 in the 7MM |

| 3.2 | Market Share (%) Distribution of ET in 2034 in the 7MM |

| 4 | Methodology |

| 5 | Executive Summary |

| 6 | Key Events |

| 7 | Disease Background and Overview |

| 7.1 | Introduction |

| 7.2 | Etiology |

| 7.3 | Risk Factors |

| 7.4 | Signs and Symptoms |

| 7.5 | Pathogenesis |

| 7.6 | Pathophysiology |

| 7.7 | Prognosis |

| 7.7.1 | Survival Risk Models in ET |

| 7.8 | Case Study of Prevalence and Phenotype of MPN Driver Mutations in ET |

| 7.9 | Diagnosis |

| 7.9.1 | Life Expectancy |

| 7.9.2 | Diagnostic Algorithm |

| 7.9.3 | Differential Diagnosis |

| 7.9.4 | Diagnosis Guidelines |

| 8 | Treatment and Management of ET |

| 8.1 | Treatment Overview |

| 8.1.1 | More on Risk-adapted Therapy: Very Low or Low Risk With or Without Extreme Thrombocytosis |

| 8.1.2 | More on Risk-adapted Therapy: High- or Intermediate-risk Disease |

| 8.2 | Treatment Algorithm |

| 8.3 | Treatment Guidelines |

| 8.3.1 | Treatment for Very-low-risk or Low-risk or Intermediate-risk ETa |

| 8.3.2 | Treatment for High-risk ETa |

| 9 | Epidemiology and Patient Population |

| 9.1 | Key Findings |

| 9.2 | Assumptions and Rationale |

| 9.2.1 | The United States |

| 9.2.2 | EU4 and the UK |

| 9.2.3 | Japan |

| 9.3 | Total Diagnosed Prevalent Cases of ET in 7MM |

| 9.4 | Total Treated Cases of ET in 7MM |

| 9.5 | The United States |

| 9.5.1 | Total Diagnosed Prevalent Cases of ET in the United States |

| 9.5.2 | Symptom-specific Cases of ET in the United States |

| 9.5.3 | Gender-specific Cases of ET in the United States |

| 9.5.4 | Mutation-specific Cases of ET in the United States |

| 9.5.5 | Risk-specific Cases of ET in the United States |

| 9.5.6 | Age-specific Cases of ET in the United States |

| 9.5.7 | Treated Cases of ET in the United States |

| 9.6 | EU4 and the UK |

| 9.6.1 | Total Diagnosed Prevalent Cases of ET in EU4 and the UK |

| 9.6.2 | Symptom-specific Cases of ET in EU4 and the UK |

| 9.6.3 | Gender-specific Cases of ET in EU4 and the UK |

| 9.6.4 | Mutation-specific Cases of ET in EU4 and the UK |

| 9.6.5 | Risk-specific Cases of ET in EU4 and the UK |

| 9.6.6 | Age-specific Cases of ET in EU4 and the UK |

| 9.6.7 | Total Treated Cases of ET in EU4 and the UK |

| 9.7 | Japan |

| 9.7.1 | Total Diagnosed Prevalent Cases of ET Japan |

| 9.7.2 | Symptom-specific Cases of ET in Japan |

| 9.7.3 | Gender-specific Cases of ET in Japan |

| 9.7.4 | Mutation-specific Cases of ET in Japan |

| 9.7.5 | Risk-specific Cases of ET in Japan |

| 9.7.6 | Age-specific Cases of ET in Japan |

| 9.7.7 | Treated Cases of ET in Japan |

| 10 | Patient Journey |

| 11 | Marketed Therapies |

| 11.1 | PEGASYS (peginterferon alfa-2a): pharma& |

| 11.1.1 | Product Description |

| 11.1.2 | Regulatory Milestones |

| 11.1.3 | Other Developmental Activities |

| 11.1.4 | Clinical Development |

| 11.1.5 | Safety and Efficacy |

| 12 | Emerging Therapies |

| 12.1 | Key Cross |

| 12.2 | BESREMi (ropeginterferon alfa-2b/P1101): AOP Orphan Pharmaceuticals AG/PharmaEssentia |

| 12.2.1 | Product Description |

| 12.2.2 | Other Developmental Activities |

| 12.2.3 | Clinical Developmental Activities |

| 12.2.4 | Safety and Efficacy |

| 12.2.5 | Analyst View |

| 12.3 | Bomedemstat (MK-3543/IMG-7289): Merck Sharp and Dohme |

| 12.3.1 | Product Description |

| 12.3.2 | Other Developmental Activities |

| 12.3.3 | Clinical Developmental Activities |

| 12.3.4 | Safety and Efficacy |

| 12.3.5 | Analyst View |

| 13 | Essential Thrombocythemia (ET): 7 Major Market Analysis |

| 13.1 | Key Findings |

| 13.2 | Market Outlook |

| 13.3 | Conjoint Analysis |

| 13.4 | Key Market Forecast Assumptions |

| 13.4.1 | Cost Assumptions and Rationale |

| 13.4.2 | Pricing Trends |

| 13.4.3 | Analogue Assessment |

| 13.4.4 | Launch Year and Therapy uptake |

| 13.5 | Market Size of ET in the 7MM |

| 13.6 | The United States |

| 13.6.1 | Total Market Size of ET in the United States |

| 13.6.2 | Market Size of ET by Therapies in the United States |

| 13.7 | EU4 and the UK |

| 13.7.1 | Total Market Size of ET in EU4 and the UK |

| 13.7.2 | Market Size of ET by Therapies in EU4 and the UK |

| 13.8 | Japan |

| 13.8.1 | Total Market Size of ET in Japan |

| 13.8.2 | Market Size of Essential Thrombocythemia by Therapies in Japan |

| 14 | KOL Views |

| 15 | SWOT Analysis |

| 16 | Unmet Needs |

| 17 | Market Access and Reimbursement |

| 17.1 | United States |

| 17.1.1 | Centre for Medicare and Medicaid Services (CMS) |

| 17.2 | EU4 and the UK |

| 17.2.1 | Germany |

| 17.2.2 | France |

| 17.2.3 | Italy |

| 17.2.4 | Spain |

| 17.2.5 | United Kingdom |

| 17.3 | Japan |

| 17.3.1 | MHLW |

| 18 | Appendix |

| 18.1 | Bibliography |

| 18.2 | Report Methodology |

| 19 | DelveInsight Capabilities |

| 20 | Disclaimer |

Related Reports

Essential Thrombocythemia Epidemiology Forecast

Essential Thrombocythemia Epidemiology Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted Essential Thrombocythemia epidemiology in the 7MM, i.e., the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan.

Essential Thrombocythemia Pipeline

Essential Thrombocythemia Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key Essential Thrombocythemia companies, including PharmaEssentia, Imago BioSciences, Novartis, Constellation Pharmaceuticals, among others.

Polycythemia Vera Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key polycythemia vera companies, including Incyte, Novartis, PharmaEssentia, AOP Orphan Pharmaceuticals, Protagonist Therapeutics, Merck (Imago BioSciences), Italfarmaco, Ionis Pharmaceutical, Silence Therapeutics, Perseus Proteomics, AbbVie, Johnson & Johnson Innovative Medicine, Mabwell (Shanghai) Bioscience, Disc Medicine, GluBio Therapeutics, among others.

Polycythemia Vera Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key polycythemia vera companies, including Silence Therapeutics, Ionis Pharmaceuticals, Perseus Proteomics, Kartos Therapeutics, Disc Medicine, among others.

Myelofibrosis Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key myelofibrosis companies, including MORPHOSYS, GERON, BRISTOL MYERS SQUIBB, KARTOS THERAPEUTICS, among others.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Consulting Services

Healthcare Conference Coverage

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter