Pune, March 13, 2025 (GLOBE NEWSWIRE) -- Global Hemostats Market Overview:

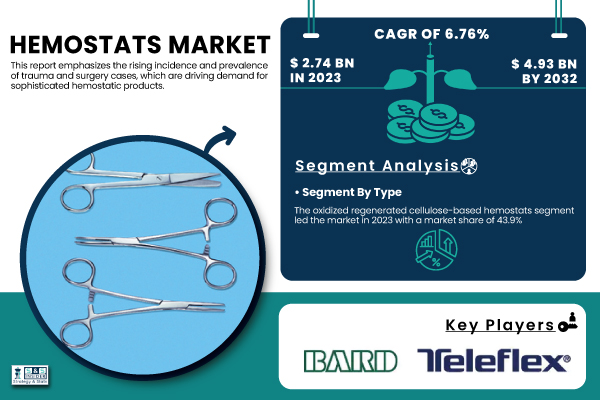

“According to SNS Insider, the global Hemostats Market size was valued at USD 2.74 billion in 2023, is forecasted to reach USD 4.93 billion by 2032, growing at a CAGR of 6.76% from 2024 to 2032.”

This growth is driven by an increasing volume of surgeries across various medical fields, advancements in hemostatic agents, and the rising demand for efficient blood control products. The growing incidence of chronic conditions such as cardiovascular diseases and orthopedic disorders has contributed to a higher number of surgical interventions, thereby increasing the demand for hemostats.

Technological advancements in hemostatic solutions, including the introduction of combination hemostats and bioactive agents, are improving surgical outcomes and reducing procedural complications. Additionally, the shift towards minimally invasive procedures has necessitated the development of more effective and faster-acting hemostatic products. The expanding geriatric population, coupled with an increasing focus on patient safety and surgical efficiency, further supports the market’s upward trajectory.

Get a Sample Report of Hemostats Market@ https://www.snsinsider.com/sample-request/3086

Key Hemostats Companies Profiled this Report are:

- Johnson & Johnson – SURGICEL, EVICEL, SURGIFLO

- CryoLife, Inc (Artivion) – PerClot, BioGlue

- Integra LifeSciences Corporation – SurgiMend, DuraGen

- Pfizer – Tisseel, Floseal

- B. Braun Melsungen AG – Aesculap Hemostat, Coseal

- Becton, Dickinson, and Company (BD) – Arista AH, Instat

- Medtronic – Recothrom, Veriset

- Baxter – Tisseel, Hemopatch

- Stryker Corporation – SealFoam, HyperBranch

- Z-Medica (Acquired by Teleflex) – QuikClot, HemCon

Hemostats Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 2.74 billion |

| Market Size by 2032 | US$ 4.93 billion |

| CAGR | CAGR of 6.76% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Segment Analysis

By Type

Oxidized regenerated cellulose-based hemostats contributed the largest share in the market in 2023, which was 43.9% of the revenue. They are most commonly used because they are easy to apply, biocompatible, and can effectively manage mild to moderate bleeding. They are especially useful in surgeries when there is an urgent need for hemostasis, which helps in saving operative time and ensuring better patient outcomes.

Combination hemostats are poised to be the most rapidly growing segment during the forecast period. Their capability to combine several hemostatic agents improves their effectiveness in bleeding control, particularly in complicated procedures. The increasing use of these innovative products is fueled by their higher performance levels as compared to the older hemostats, and this factor contributes to increased popularity among medical professionals.

By Formulation

Matrix & gel hemostats captured 37.9% of total revenue in 2023 and dominated the market by formulation. Their simplicity of use, flexibility to suit various surgical requirements, and extreme efficiency at stopping bleeding have propelled their mass use in general and specialized surgical procedures.

The sponge hemostats category is anticipated to experience the greatest growth rate. These hemostats are capable of quick action and superior absorbency, thereby being best suited for emergency cases and trauma situations. The surge in the adoption of sponge-based products across a range of surgical disciplines is because they are convenient to handle, have less preparation time, and are effective at controlling severe hemorrhage.

By Application

Orthopedic procedures captured the highest market share in 2023 at 30.01% of the total revenue. The segment's high demand for hemostats is a result of the rising incidence of bone fractures, joint replacement operations, and spinal procedures. Because bones are highly vascular, effective control of bleeding is paramount in orthopedic procedures, thus the widespread use of hemostats.

Cardiovascular procedures are expected to be the fastest-growing category in the future. The increasing prevalence of heart ailments, combined with a growing volume of bypass surgeries and valve replacements, has stimulated demand for effective hemostats in this specialty. The urgency of cardiovascular procedures renders sophisticated hemostats an absolute necessity to minimize surgical complications and enhance patient recovery.

By End-Use

Hospitals and clinics were the largest end-users of hemostats in 2023 with a market share of 45.02%. The segment witnesses high demand due to the volume of surgeries being conducted in hospital environments, which necessitates effective hemostatic products to control blood loss and improve surgical efficacy.

Casualty care facilities are expected to record the highest growth rate in the hemostats market. Increased trauma cases, road accidents, and emergency procedures have resulted in a greater dependency on hemostats for rapid bleeding control. Increased focus on emergency care infrastructure and the increase in ambulatory surgical centers are the major reasons for the quick growth of this segment.

Need any customization research on Hemostats Market, Enquire Now@ https://www.snsinsider.com/enquiry/3086

Hemostats Market Segmentation

By Type

- Thrombin-based Hemostats

- Oxidized Regenerated Cellulose-based Hemostats

- Combination Hemostats

- Others

By Formulation

- Matrix & Gel Hemostats

- Sponge Hemostats

- Powder Hemostats

- Others

By Application

- Orthopedic Surgery

- General Surgery

- Neurological Surgery

- Cardiovascular Surgery

- Others

By End-use

- Hospitals & Clinics

- Ambulatory Surgical Centers (ASCs)

- Casualty Care Centers

- Others

Regional Analysis

North America dominated the hemostats market in 2023 with a 33.06% share of overall revenue. The region's dominance is owed to its highly developed healthcare infrastructure, high volume of surgeries, and presence of major market players. Growing use of sophisticated hemostatic products and ongoing R&D investments further support North America's market leadership.

The Asia-Pacific market is projected to register the maximum growth rate. Drivers for growth in the region include increased healthcare spending, aging population, and the number of surgeries performed in countries like India and China. Increased investment in healthcare infrastructure and rising awareness about newer surgical procedures are also propelling the adoption of hemostat in the region at a rapid rate.

Recent Developments in the Hemostats Market

- October 2024: Medcura, Inc. revealed that its LifeGel Absorbable Hemostatic Gel received the 2024/2025 Best Technology in Spine Award for its innovations in biopolymer-based hemostatic technology for surgical control of bleeding.

- July 2023: Baxter International Inc. introduced PERCLOT Absorbable Hemostatic Powder in the U.S., strengthening its portfolio of passive hemostatic solutions.

- April 2023: Olympus launched EndoClot Adhesive (ECA), EndoClot Polysaccharide Hemostatic Spray (PHS), and EndoClot Submucosal Injection Solution (SIS) in the EMEA market to further increase hemostatic treatment solutions for endoscopic procedures.

Buy a Single-User PDF of Hemostats Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/3086

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence of Surgeries & Trauma Cases (2023)

5.2 Prescription and Utilization Trends of Hemostats (2023), by Region

5.3 Healthcare Spending on Hemostatic Products, by Region (Government, Commercial, Private, Out-of-Pocket) (2023)

5.4 R&D Investments and Innovations in Hemostats (2023-2032)

5.5 Impact of Regulatory Policies and Safety Guidelines on Hemostats Market (2023-2032)

6. Competitive Landscape

7. Hemostats Market by Type

8. Hemostats Market by Formulation

9. Hemostats Market by Application

10. Hemostats Market by End-use

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Details of Hemostats Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/reports/hemostats-market-3086

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.