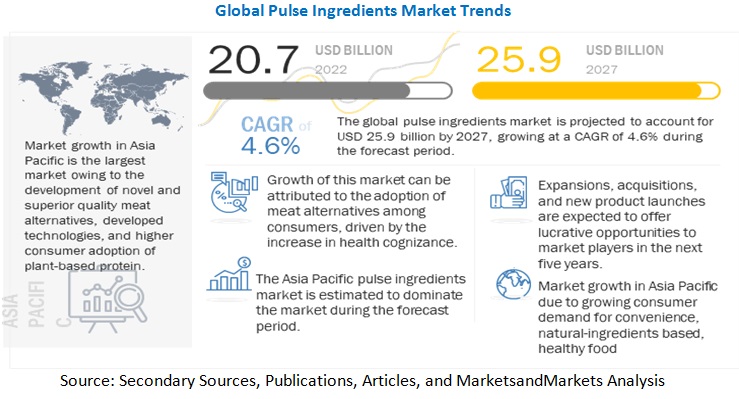

Delray Beach, FL, March 13, 2025 (GLOBE NEWSWIRE) -- The global pulse ingredients market was estimated to be valued at USD 20.7 billion in 2022. It is projected to reach USD 25.9 billion by 2027, recording a CAGR of 4.6% during the forecast period. The sector is undergoing significant transformations at global, regional, and country levels to address the increasing demand amidst sluggish production growth.

Rising Demand for Pulse Ingredients

Pulse ingredients play a vital role in providing an alternative protein source to consumers. While soy and pea protein dominate new vegan product formulations in Europe, the rising demand for plant-based protein presents an opportunity to diversify protein sources. This shift could introduce a variety of pulses and new protein sources such as sprouted grains, paving the way for new supplier countries to offer high-quality bean varieties.

Opportunities in Emerging Markets

Emerging economies, particularly India and China in the Asia-Pacific region, are showcasing immense growth potential for pulse ingredients. The region offers cost advantages in production and processing, which, combined with high demand, makes it an attractive market for suppliers and manufacturers.

The increasing number of working women, nuclear families, and evolving lifestyles have led to a surge in demand for convenience and ready-to-eat (RTE) foods. As consumers seek time-saving meal options, the market for snacks, bakery products, soups, and RTE meals containing pulse ingredients is witnessing a significant boost.

Additionally, emerging markets such as Brazil and the Middle East present untapped opportunities due to their growing economies and increased consumer spending on processed foods. Developed economies, on the other hand, have reached market maturity with limited growth potential in this sector.

Chickpea Segment: Fastest Growing Category

Chickpeas, also known as garbanzo beans, are a rich source of proteins, vitamins, minerals, and dietary fiber. According to the Food and Agriculture Organization (FAO), India was the largest producer of chickpeas in 2019, contributing nearly 70% of the global supply.

The two primary varieties of chickpeas are Desi and Kabuli. While the Kabuli variety is grown in West Asia and the Mediterranean region, the Desi type is predominantly cultivated in the Indian subcontinent. The rising consumption of chickpeas and their diverse applications in food and beverage industries are expected to drive significant growth in this segment.

For a comprehensive overview, download the PDF copy

Asia-Pacific: The Leading Market for Pulse Ingredients

Asia-Pacific pulse ingredients market is projected to be the largest market, driven by the rapid population growth, rising disposable incomes, and increasing consumer preference for functional ingredients.

According to FAO data from 2018, the region accounted for nearly 49% of global pulse production, with India alone contributing 57% of the total. Major pulse crops cultivated in India include chickpeas, peas, green gram, black gram, and lentils. Given the region’s substantial production capacity and growing consumer interest in plant-based nutrition, the demand for pulse ingredients is expected to experience robust growth.

The global pulse ingredients market is poised for steady expansion, fueled by growing consumer demand for plant-based proteins, increasing preference for convenience foods, and significant opportunities in emerging economies. With Asia-Pacific leading the market in production and consumption, companies investing in this sector stand to benefit from the evolving dietary trends and rising health consciousness among consumers.

Top Companies in Pulse Ingredients Market

- Ingredion (US)

- Roquette Freres (France)

- ADM (US)

- Emsland Group (Germany)

- The Scoular Company (US)

- AGT Food & Ingredients (Canada)

- Anchor Ingredients (Canada)

- Batory Foods (US)

- Vestkorn Milling As (Norway)

- Dakota Ingredients (US)

- Puris (US)

- Axiom Foods (US)

Arrange a call with our Analysts to delve into your business objectives