Pune, March 18, 2025 (GLOBE NEWSWIRE) -- Biologics Market Size & Growth Analysis:

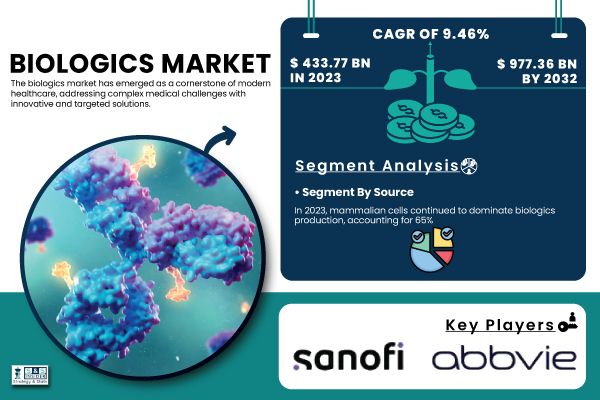

According to SNS Insider, the Global Biologics Market was valued at USD 433.77 billion in 2023, is projected to reach USD 977.36 billion by 2032, expanding at a CAGR of 9.46% over the forecast period of 2024-2032.

Biologics, including monoclonal antibodies, recombinant proteins, and gene therapies, have revolutionized treatment protocols for chronic and complicated diseases. The increasing prevalence of diseases like cancer, autoimmune diseases, and orphan genetic diseases has dramatically raised the demand for biologics. The growth of the market is also supplemented by continuous research in biotechnology, genetic engineering, and cell culture methods, resulting in more potent and targeted drugs.

The increasing focus on personalized medicine and the rising use of biosimilars are major market growth drivers. Regulatory bodies are also streamlining approvals for biologics, facilitating quicker patient access to new treatments. Growth in the industry is anticipated to be supported by higher government and private investments in biopharmaceutical R&D and infrastructure during the forecast period.

Get a Sample Report of Biologics Market@ https://www.snsinsider.com/sample-request/5539

Key Biologics Companies Profiled

- Samsung Biologics

- Amgen Inc.

- Novo Nordisk A/S

- AbbVie Inc.

- Sanofi

- Johnson & Johnson Services, Inc.

- Celltrion Healthcare Co., Ltd.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- GlaxoSmithKline PLC

- Merck & Co.

- Pfizer Inc.

- AstraZeneca PLC

Biologics Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 433.77 billion |

| Market Size by 2032 | US$ 977.36 billion |

| CAGR | CAGR of 9.46% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Segment Analysis

By Source

Mammalian cells continued to be the leading source in biologics manufacturing during 2023, holding a market share of 65%. Mammalian cell lines are used extensively owing to their potential to generate human-like, intricate proteins with suitable post-translational modifications to provide maximum therapeutic effectiveness and lowered immunogenicity. Mammalian cell-based expression systems are pivotal in manufacturing monoclonal antibodies, recombinant proteins, and fusion proteins.

The most rapidly growing source for the production of biologics is microbial systems. Microbial systems are becoming more favored because they are cost-effective, have fast production times, and can efficiently express smaller biologic molecules. The development of synthetic biology and metabolic engineering has also improved the yield and scalability of microbial expression platforms, making them more popular in the industry.

By Product

Monoclonal antibodies (mAbs) dominated the biologics market's top product segment in 2023, accounting for almost 45% of the market share. The extensive utilization of mAbs in the treatment of oncology, autoimmune diseases, and infectious diseases has reinforced their stronghold. Their specificity in targeting particular antigens with great accuracy has rendered them a drug of choice among a variety of indications. Developments in antibody engineering, such as bispecific and antibody-drug conjugates, are still fueling growth within this segment.

Antisense and RNA interference (RNAi) medicines are the most rapidly expanding product category. Such novel therapies are based on the mechanism of silencing particular genes that contribute to disease pathology, providing a very targeted therapy against previously incurable diseases. Improved approvals and positive clinical trial data have spurred the take-up of these treatments, and this has witnessed heightened investment in drug development involving RNA. Their capacity for RNA-level modulating of gene expression has put them at the forefront as the driving force behind the biologics market of the future.

Need Any Customization Research on Biologics Market, Enquire Now@ https://www.snsinsider.com/enquiry/5539

Biologics Market Segmentation

By Source

- Microbial

- Mammalian

- Others

By Product

- Monoclonal Antibodies

- MABs by Application

- Diagnostic

- Biochemical Analysis

- Diagnostic Imaging

- Therapeutic

- Direct MAB Agents

- Targeting MAB Agents

- Protein Purification

- Others

- Diagnostic

- MABs by Type

- Murine

- Chimeric

- Humanized

- Human

- Others

- MABs by Application

- Vaccines

- Recombinant Proteins

- Antisense & RNAi Therapeutics

- Others

By Disease Category

- Oncology

- Infectious Diseases

- Immunological Disorders

- Cardiovascular Disorders

- Hematological Disorders

- Others

By Manufacturing

- Outsourced

- In-house

Regional Analysis

North America remained the global leader in the biologics market, with a 45% share in 2023. Its dominance is because of a robust biopharmaceutical sector, sophisticated healthcare infrastructure, and heavy investments in R&D. Good regulatory environments and the presence of big biopharma firms also add to market growth.

The Asia-Pacific region will be the most rapidly growing market for biologics during the forecast period. Growing healthcare spending, higher incidence of chronic diseases, and enhanced capabilities in biopharmaceutical production are driving rapid market growth. Government support for local biologics production and the growing usage of biosimilars across emerging markets will further spur growth in this region.

Recent Developments in the Biologics Market

- January 2025 – The U.S. FDA accepted the Biologics License Application (BLA) for LEQEMBI, a subcutaneous autoinjector for weekly maintenance dosing in the treatment of early Alzheimer’s disease. The Prescription Drug User Fee Act (PDUFA) action date is scheduled for August 31, 2025.

- January 2025 – Cytovance Biologics and PolyPeptide partnered to develop and manufacture peptide-based biologic drugs. This collaboration enhances peptide drug manufacturing capabilities using microbial and mammalian expression systems.

- January 2025 – Samsung Biologics signed its largest-ever contract manufacturing organization (CMO) agreement, valued at USD 1.4 billion, with a European pharmaceutical company. This deal accounts for 40% of the company’s expected orders for 2024.

- March 2025 – Roche announced a major expansion of its biologics manufacturing facilities to support increased global demand for monoclonal antibodies and next-generation biologics. The expansion aims to enhance production capacity and streamline supply chain efficiency.

Statistical Insights and Trends Reporting

- RNA-based therapies are witnessing the fastest growth, driven by increased adoption in rare and genetic disease treatments.

- Over 500 biologics candidates are currently in various stages of clinical trials, indicating a strong pipeline for future market growth.

- RNA-based therapies and gene editing approaches are seeing increased investment from biopharma companies.

- Governments worldwide invested over USD 50 billion in biologics research and development in 2023.

- Private sector funding in biologics innovation continues to rise, particularly in next-generation cell and gene therapies.

- Biopharmaceutical companies are expanding biologics manufacturing facilities, with a projected 20% increase in global production capacity by 2032.

- Advancements in single-use bioreactor technology are improving scalability and cost-efficiency in biologics production.

Buy a Single-User PDF of Biologics Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/5539

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence of Chronic Diseases (2023)

5.2 Prescription Trends (2023), by Region

5.3 Healthcare Spending, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

7. Biologics Market by Source

8. Biologics Market by Product

9. Biologics Market by Disease Category

10. Biologics Market by Manufacturing

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Details of Biologics Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/reports/biologics-market-5539

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.