Austin, March 20, 2025 (GLOBE NEWSWIRE) -- Embedded Security Market Size & Growth Insights:

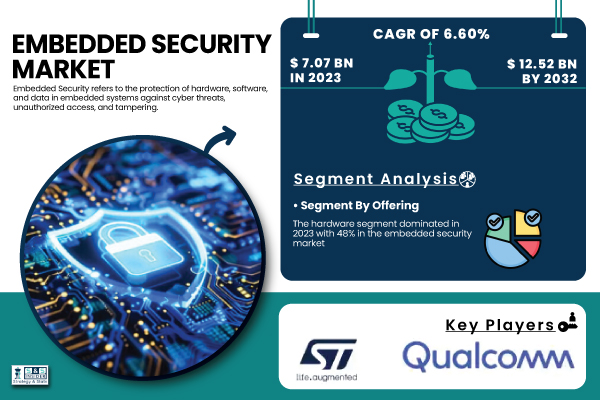

According to the SNS Insider,“The Embedded Security Market Size was valued at USD 7.07 Billion in 2023 and is expected to reach USD 12.52 Billion by 2032 and grow at a CAGR of 6.60% over the forecast period 2024-2032.”

Securing the Future: Rising Demand for Embedded Security Solutions

The embedded security market is expanding rapidly, fueled by the rising adoption of connected devices and the growing IoT ecosystem. With over 18.8 billion IoT devices and 400+ active platforms worldwide, the demand for robust security solutions has never been more pressing. IoT devices, from smart home systems to industrial sensors, often operate in vulnerable environments, making them prime targets for cyber threats. Technologies like secure boot, hardware-based encryption, and trusted execution environments are essential for protecting these devices and ensuring system integrity. This is particularly crucial in healthcare, where remote monitoring tools and wearables handle sensitive patient data, requiring stringent security measures.

Get a Sample Report of Embedded Security Market Forecast @ https://www.snsinsider.com/sample-request/1561

Leading Market Players with their Product Listed in this Report are:

- Infineon Technologies (OPTIGA Trust M, OPTIGA TPM)

- NXP Semiconductors (EdgeLock SE050, LPC55S69)

- STMicroelectronics (STM32 Secure, STSAFE-A100)

- Qualcomm (Snapdragon Secure, Qualcomm Mobile Security)

- Microchip Technology (Trust Platform, ATECC608A)

- Renesas Electronics (RA Secure, RXv2)

- Arm Holdings (Cortex-M55, Arm TrustZone)

- Texas Instruments (CC3200, Tiva C Series)

- Broadcom (CryptoAuth, BCM4330)

- SecureRF (SecureRF’s Embedded Cryptographic Engine, RFID Security)

- On Semiconductor (SecurEdge, NCS5630)

- Thales Group (nShield Edge, SafeNet Authentication)

- Maxim Integrated (MAXQ1061, MAXQ2030)

- Cypress Semiconductor (now part of Infineon) (CYASSIST, CY8CMBR3108)

- Atmel (now part of Microchip) (ATSHA204A, SAM D21)

- Microsemi (now part of Microchip) (Secure Embedded Platform, SmartFusion2)

- MicroVision (Embedded Vision System, Security Camera Technology)

- Gemalto (now part of Thales) (IDPrime 940, SafeNet HSM)

- Spyrus (SPYRUS Secure Flash Drive, SPYRUS Hardware Security Module)

- HID Global (iCLASS SE, FIDO U2F).

Embedded Security Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 7.07 Billion |

| Market Size by 2032 | USD 12.52 Billion |

| CAGR | CAGR of 6.60% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Offering (Hardware, Software, Services) • By Security Type (Authentication And Access Management, Payment, Content Protection) • By Application (Wearables, Smartphones, Automotive, Smart Identity Cards, Industrial, Payment Processing And Card, Others) |

| Key Drivers | • A key factor propelling the embedded security market is the rising occurrence and complexity of cybersecurity threats. • The automotive sector is experiencing a transition towards self-driving cars (AVs), which depend significantly on the embedded systems market for functionality. |

Do you Have any Specific Queries or Need any Customize Research on Embedded Security Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/1561

The financial sector significantly drives market growth, with digital transactions surpassing 500 million daily in September 2024, up from 483 million in August. With increased reliance on ATMs, POS terminals, and online payments, embedded security solutions—such as hardware security modules (HSMs) and tamper-resistant chips—are critical in preventing fraud and ensuring compliance with regulations. As cyber threats evolve, industries are increasingly investing in scalable and innovative security solutions to protect sensitive data and maintain consumer trust. The embedded security market will continue to play a pivotal role in securing digital transformation across various sectors.

Embedded Security Market Trends: Growth in Hardware and Authentication Solutions

By Offering

In 2023, the hardware segment dominated the embedded security market with a 48% share, driven by the growing need for secure physical components in IoT systems, automotive electronics, and consumer devices. Hardware-based security, including secure elements, trusted platform modules (TPMs), and hardware security modules (HSMs), provides robust protection against cyber threats. Leading companies like Infineon Technologies and NXP Semiconductors offer secure microcontrollers and chips that enhance data encryption and device integrity.

The services segment is expected to grow the fastest from 2024 to 2032 due to rising cybersecurity threats. Organizations increasingly rely on security consulting, managed services, and risk assessments from providers like Thales (formerly Gemalto) and Synopsys to maintain protection against evolving attacks.

By Security Type

The payment segment led with a 46% market share in 2023, fueled by demand for secure e-commerce and contactless payments. Secure elements and TPMs ensure encrypted transactions, with Visa, MasterCard, and Thales playing key roles in enhancing digital payment security.

Authentication and access management are projected to be fastest Growing over the forecast period 2024-2032, as businesses adopt multi-factor authentication (MFA), biometrics, and hardware-based authentication to prevent unauthorized access. Companies like Microsoft, Okta, and Apple are advancing embedded security through Face ID, Touch ID, and enterprise security solutions.

Regional Dynamics in the Embedded Security Market: North America Leads, APAC Rapid Growth

North America dominated the embedded security market in 2023, holding a 38% share, driven by high demand for secure embedded systems across automotive, aerospace, and consumer electronics industries. The U.S. remains a key contributor, with companies like Intel, Qualcomm, and Texas Instruments developing advanced secure processors and encryption technologies. Strong regulatory frameworks further support market growth by enforcing stringent security measures for IoT devices, ensuring protection against cyber threats. Aerospace and defense giants like Lockheed Martin and Honeywell integrate embedded security solutions, reinforcing regional demand.

The Asia-Pacific (APAC) region is poised to be the fastest-growing market from 2024 to 2032, fueled by rapid industrial expansion in China, India, Japan, and South Korea. The surge in IoT adoption, smart home systems, and industrial automation necessitates advanced embedded security to safeguard data and devices. Leading players like Samsung and Sony incorporate robust security features in smartphones, wearables, and consumer electronics. Additionally, China’s focus on technological self-reliance and its heavy investments in 5G infrastructure further accelerate the demand for embedded security solutions. With increasing cybersecurity concerns worldwide, both regions are set to play pivotal roles in shaping the future of embedded security technologies.

Purchase Single User PDF of Embedded Security Market Report (33% Discount) @ https://www.snsinsider.com/checkout/1561

Recent Development

- April 11, 2024: Infineon and Green Hills Software Unveil Real-Time Platform for SDVs Infineon Technologies and Green Hills Software have introduced a microcontroller-based platform integrating Aurix TC4x MCUs with the µ-velOSity RTOS for safety-critical automotive applications. This solution enhances domain controllers, EV drivetrains, and SDV architectures with secure, real-time processing.

- March 10, 2025: Mouser Highlights NXP’s FRDM-MCXW71 Development Board NXP’s FRDM-MCXW71 Development Board, powered by the MCXW71 wireless MCU with Arm Cortex-M33, supports Bluetooth LE, Zigbee, Thread, and Matter for IoT applications, offering integrated debugging tools and versatile connectivity.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Embedded Security R&D Spending Trends

5.2 Integration & Adoption Rates

5.3 Regulatory & Policy Impact

5.4 Usage Statistics, 2023

6. Competitive Landscape

7. Embedded Security Market Segmentation, by Offering

8. Embedded Security Market Segmentation, by Security Type

9. Embedded Security Market Segmentation, by Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access More Research Insights of Embedded Security Market Growth & Outlook Report 2024-2032@ https://www.snsinsider.com/reports/embedded-security-market-1561

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.