Austin, March 25, 2025 (GLOBE NEWSWIRE) -- Consumer Network Attached Storage Market Size & Growth Insights:

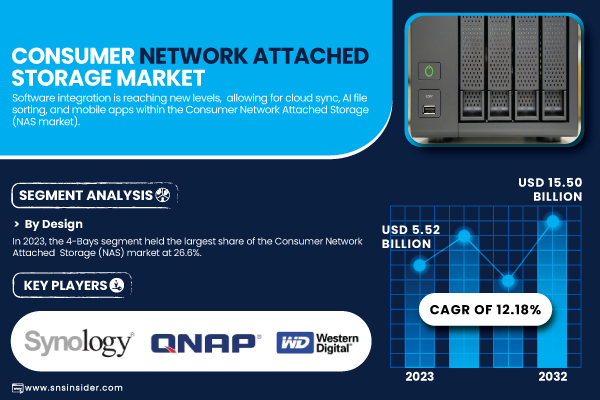

According to the SNS Insider,“The Consumer Network Attached Storage Market Size was valued at USD 5.52 Billion in 2023 and is expected to reach USD 15.50 Billion by 2032 and grow at a CAGR of 12.18% over the forecast period 2024-2032.”

Growth Driven by High-Capacity Storage Demand and Smart Integration

The market is evolving with advanced software integration, including cloud sync, AI-driven file organization, and mobile app compatibility, enhancing user experience and efficiency. Rising personal data creation, particularly high-capacity storage needs driven by 4K/8K videos, high-resolution images, and gaming, is fueling demand. The U.S. Consumer Network Attached Storage (NAS) market, valued at USD 1.16 billion in 2023, is projected to reach USD 3.01 billion by 2032, growing at a CAGR of 11.18%.

Get a Sample Report of Consumer Network Attached Storage Market Forecast @ https://www.snsinsider.com/sample-request/5928

Leading Market Players with their Product Listed in this Report are:

- Synology (DiskStation DS220+, DiskStation DS920+)

- QNAP Systems (TS-251D, TS-453D)

- Western Digital (My Cloud Home, My Cloud EX2 Ultra)

- Seagate Technology (Personal Cloud, IronWolf 110 SSD)

- NETGEAR (ReadyNAS 424, ReadyNAS 214)

- ASUSTOR (AS1002T, AS5304T)

- Buffalo Technology (LinkStation 220, TeraStation 3210DN)

- TerraMaster (F2-210, F5-422)

- Drobo (5N2, B810n)

- Apple Inc. (Time Capsule, AirPort Extreme)

- Lenovo (EMC px2-300d, Iomega ix2)

- HP Inc. (Media Vault mv2020, StorageWorks X500)

- Dell Technologies (PowerVault NX400, PowerVault NX3240)

- ASRock (NAS Killer 4.0, Rackmount 4U)

- ZyXEL Communications (NAS326, NAS540).

Consumer Network Attached Storage Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 5.52 Billion |

| Market Size by 2032 | USD 15.50 Billion |

| CAGR | CAGR of 12.18% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Design (1-Bay, 2-Bays, 4-Bays, 5-Bays, 6-Bays, Above 6-Bays) • By Mount Type (Standalone, Rackmount) • By Storage Type (Hard Disk Drive (HDD), Flash Storage, Hybrid) • By Storage Capacity (Less than 1 TB, 1 TB to 20 TB, More than 20 TB) • By Deployment (On-Premise, Cloud/ Remote, Hybrid) • By End Use (Residential, Business) |

| Key Drivers | • Rising Demand for High-Capacity Secure and Smart Consumer NAS Solutions in the Digital Era. • AI-powered SSD NAS Hybrid Cloud and Subscription Models Unlock Growth Opportunities in Consumer Storage. |

Do you Have any Specific Queries or Need any Customize Research on Consumer Network Attached Storage Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/5928

Intuitive interfaces, remote accessibility and automated backups take priority for consumers, while comprehensive security features like encryption, multi-factor authentication and energy efficiency remain critical. NAS solutions are rapidly adopted due to their affordability, safety and scalability, allowing them to seamlessly integrate into smart home ecosystems. The need for continuous and reliable storage is driving demand for smart home devices, IoT applications, and home security systems. Furthermore, the advent of AI-powered data management, alongside concerns regarding the security of cloud storage, is further redirecting users toward local NAS solutions as a more secure option.

Key Industry Segmentation:

By Design

In 2023, the 4-Bays segment dominated the Consumer Network Attached Storage (NAS) market with a 26.6% share, which can be attributed to the balance of storage capacity and affordability, making them perfect options for home users and small business purposes. It continues to be a favorite for media streaming, data backup, and personal cloud storage.

The 2-Bays segment is projected to grow at the fastest CAGR from 2024 to 2032, owing to rising adoption of affordable, entry-level NAS solutions. On-net, other growth drivers include its simple RAID setup, compact design, and growing adoption by home users and freelancers who prefer reliable local storage over cloud services.

By Mount Type

In 2023, the standalone segment dominated the Consumer Network Attached Storage (NAS) market with a 63.6% share and is expected to grow at the fastest CAGR from 2024 to 2032. Its popularity is driven by user-friendly, plug-and-play functionality that requires no installation, making it ideal for home users and small businesses. Standalone NAS devices offer high storage capacity, remote access, and robust data security, reducing reliance on cloud services. The rising consumption of digital content, growing data privacy concerns, and increasing adoption of smart home and IoT applications are further accelerating global demand for standalone NAS solutions.

By Storage Type

In 2023, the Hard Disk Drive (HDD) segment led the Consumer Network Attached Storage (NAS) market, holding a 62.2% share by value, driven by its affordability, high storage capacity, and widespread availability. While slower than SSDs, HDD-powered NAS remains popular among budget-conscious consumers and businesses requiring large data storage.

The hybrid segment is expected to grow at the fastest CAGR from 2024 to 2032, owing to the growing need higher performance, reliability, and energy efficiency. Hybrid NAS balances HDD capacity and SSD speed, making hybrid NAS perfect for higher capacity applications where speed is important for data access.

By Storage Capacity

The 1 TB to 20 TB segment dominated the market with a 60.6% share in 2023 and is projected to grow at the highest CAGR during the forecast period. Demand is driven by increasing storage needs for 4K/8K videos, gaming data, and personal cloud storage, along with remote work, smart homes, and multimedia streaming.

By Deployment Type

The On-Premise segment led the Consumer NAS market in 2023 with a 48.7% share, driven by demand for secure, high-performance storage with data privacy, direct access speed, and minimal internet dependency.

The Hybrid segment is expected to grow fastest from 2024 to 2032, combining on-premise security with cloud flexibility. This appeals to users seeking remote access, automated backups, and scalability, making hybrid NAS a key driver of future market growth.

By End Use

In 2023, the Business segment dominated the Consumer Network Attached Storage (NAS) market with a 57.3% share, driven by the rising adoption of secure, scalable, and high-capacity storage solutions among small and medium enterprises (SMEs). Businesses rely on NAS for data backup, file sharing, and collaboration, ensuring smooth workflow and efficient data management.

The Residential segment is expected to witness the fastest growth from 2024 to 2032, due to rising internet traffic, smart home integration & personal cloud storage. Still, as worries about public cloud data privacy increase, more homeowners are turning to NAS to get cheap, private storage.

Purchase Single User PDF of Consumer Network Attached Storage Market Report (33% Discount) @ https://www.snsinsider.com/checkout/5928

Consumer NAS Market Growth in North America and Asia Pacific

In 2023, North America led the Consumer Network Attached Storage (NAS) market with a 32.6% share, driven by the high adoption of advanced storage solutions, increasing data security concerns, and strong NAS vendor presence. The U.S. and Canada see dominant players like Synology, Western Digital, and QNAP, offering versatile NAS solutions for home and business use. Synology DiskStation models are particularly popular among U.S. small businesses for secure file sharing and remote access.

Asia Pacific is set to grow at the fastest CAGR (2024-2032) in the network-attached storage market. In China, Japan, and India, personal cloud and hybrid storage needs are on the rise, driven by the Chinese data localization policy that fuels growth.

Recent Development

- On November 26, 2024, QNAP confirmed that a faulty firmware update (QTS 5.2.2.2950, build 20241114) locked users out of their NAS devices. The company withdrew the update, investigated, and reissued a fixed version within 24 hours.

- On August 27, 2024, HP highlighted its Ocean-Bound Plastics Initiative, aiming to recycle plastic waste into sustainable technology. The company integrates reclaimed ocean-bound plastics into its supply chain to reduce pollution.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Software & Ecosystem Adoption Metrics

5.2 Storage Utilization & Data Management Metrics

5.3 User Experience & Satisfaction Metrics

5.4 Performance & Reliability Metrics

6. Competitive Landscape

7. Consumer Network Attached Storage Market Segmentation, by Design

8. Consumer Network Attached Storage Market Segmentation, by Mount Type

9. Consumer Network Attached Storage Market Segmentation, by Storage Type

10. Consumer Network Attached Storage Market Segmentation, by Storage Capacity

11. Consumer Network Attached Storage Market Segmentation, by Deployment

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practices

15. Conclusion

Access More Research Insights of Consumer Network Attached Storage Market Growth & Outlook Report 2024-2032@ https://www.snsinsider.com/reports/consumer-network-attached-storage-market-5928

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.