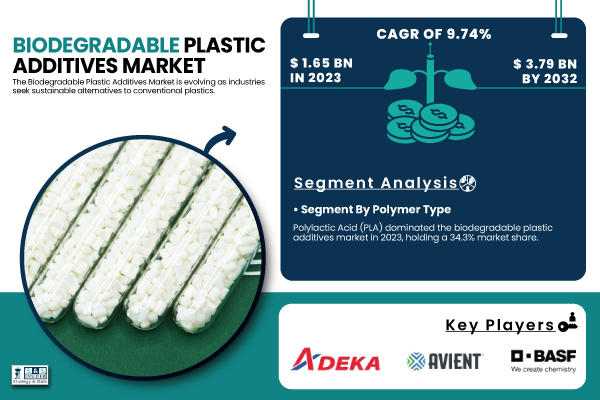

Austin, March 25, 2025 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that, “The Biodegradable Plastic Additives Market Size was valued at 1.65 Billion in 2023 and is expected to reach USD 3.79 Billion by 2032, growing at a CAGR of 9.74% over the forecast period of 2024-2032.”

Regulatory Policies and Sustainability Goals Propel Biodegradable Plastic Additives Market Growth

The biodegradable plastic additives market is expanding rapidly due to strict regulations on single-use plastics and growing sustainability initiatives. The European Union’s Single-Use Plastics Directive (SUPD) and the U.S. Plastics Pact’s 2025 goals are pushing industries toward biodegradable alternatives. Additionally, China’s plastic ban and India’s commitment to eliminating single-use plastics by 2025 are fueling demand. Companies like BASF SE and Dow Inc. are innovating to comply with these policies. The Biodegradable Products Institute (BPI) reports a 32% surge in certified compostable product demand from 2022 to 2024, reflecting a shift toward eco-friendly materials in packaging, agriculture, and automotive sectors.

The US Biodegradable Plastic Additives Market Size was valued at 0.23 Billion in 2023 and is expected to reach USD 0.56 Billion by 2032, growing at a CAGR of 10.27% over the forecast period of 2024-2032.

The US biodegradable plastic additives market is growing due to regulatory support and sustainability initiatives. The USDA’s BioPreferred Program promotes biobased products, while the Agricultural Research Service (ARS) develops innovations like milk-protein-based edible films. Companies like BASF SE and Dow Inc. are introducing biodegradable solutions to meet environmental standards. Rising consumer demand for eco-friendly packaging further drives market expansion.

Download PDF Sample of Biodegradable Plastic Additives Market @ https://www.snsinsider.com/sample-request/6083

Key Players:

- ADEKA Corporation (ADEKA Polymer Additives, ADEKA BIOBASE, ADEKA NOL)

- Add-X Biotech (AddiFlex, Add-X Biodegradable)

- Avient Corporation (OnColor Bio, Cesa Biodegradable Additives, Cesa Light Stabilizers)

- BASF (ecoflex, Irganox, Irgastab)

- BioSphere (BioSphere Biodegradable Plastic Additive, BioSphere Biodegradable Technology)

- Bio-Tec Environmental (EcoPure, Bio-Tec Additives)

- Blend Colours (BioAdd, Biodegradable Masterbatches, Bio Colours)

- Clariant AG (Licocare RBW, Licocene, Exolit)

- Colloids (Biocolloid, Biodegradable Masterbatch, Biocolloid Green)

- Corbion N.V. (Puralact, PURALACT B3, PURALACT F)

- Croda International PLC (Atmer Anti-Fog, Incroslip)

- DIC Corporation (BIOCLEAN, HYDRAN, Sunfort)

- Emery Oleochemicals (LOXIOL G, EMEROX, EDENOL)

- Evonik Industries AG (VISIOMER Terra, TEGO, VESTOSINT)

- Greenchemicals S.r.l. (GC GreenAdd, GC UV, GC Therm)

- LANXESS (Stabaxol, Preventol, Plastilit)

- Solvay (Alve-One, Omnix, Rhodoline)

- Symphony Environment (d2w, d2p)

- Willow Ridge Plastics (Reverte, Biodegradable Additive)

Biodegradable Plastic Additives Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 1.65 Billion |

| Market Size by 2032 | USD 3.79 Billion |

| CAGR | CAGR of 9.74% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Polymer Type (Polyhydroxyalkanoates (PHA), Polylactic Acid (PLA), Polybutylene Succinate (PBS), Polybutylene Adipate Terephthalate (PBAT), Starch Blends, Others) • By Foam Type (Plasticizers, Stabilizers, Flame Retardants, Antistatic Agents, Others) • By Application (Modifiers, Extenders, Stabilizers, Processing Aids, Others) • By End-Use Industry (Consumer Goods, Packaging, Healthcare, Textiles, Automotive, Agriculture, Others) |

| Key Drivers | • Rising Government Policies and Tax Incentives for Sustainable Additives Drive the Biodegradable Plastic Additives Market Growth. |

If You Need Any Customization on Biodegradable Plastic Additives Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/6083

Global Regulations and Corporate Commitments Drive Biodegradable Plastic Adoption

- Several countries have implemented bans on non-biodegradable plastics, enforcing strict guidelines for manufacturers.

- Policies such as tax benefits for sustainable packaging encourage businesses to adopt biodegradable plastic additives.

- Certification programs like ASTM D6400, EN 13432, and BPI ensure product compliance with environmental safety standards.

- Major corporations, including Nestlé, Coca-Cola, and Unilever, have pledged to use 100% recyclable or biodegradable plastic in packaging by 2030.

By Polymer Type, Polylactic Acid (PLA) Dominated the Biodegradable Plastic Additives Market in 2023 with a 34.3% Market Share

The dominance is driven by its widespread usage in packaging, textiles, and medical applications. PLA is favored due to its biocompatibility, renewable sourcing from corn starch or sugarcane, and compostability under industrial conditions. Companies such as NatureWorks LLC and Corbion N.V. have scaled up PLA production to cater to the rising demand for sustainable alternatives. Additionally, PLA is being increasingly used in 3D printing, further boosting its adoption.

By Foam Type, Plasticizers Segment Dominated the Biodegradable Plastic Additives Market in 2023 with a 29.5% Market Share

In 2023, plasticizers accounted for a major share of the biodegradable plastic additives market, making it the leading segment. Plasticizers enhance the flexibility, durability, and processability of biodegradable plastics, making them essential in applications such as food packaging, medical devices, and agricultural films. The rising use of bio-based plasticizers derived from plant oils and citric acid is further fueling the segment’s growth. Companies like Evonik Industries and Eastman Chemical Company are investing in the development of sustainable plasticizers to align with eco-friendly regulations.

By Application, Modifiers Segment Dominated the Biodegradable Plastic Additives Market in 2023 with a 26.7% Market Share

The Modifiers segment held a major share in 2023, making it the dominant application type in the biodegradable plastic additives market. Modifiers are crucial in enhancing biodegradability, tensile strength, and thermal stability of bioplastics, thereby improving their performance in various industries. The demand for bio-based polymer modifiers has surged, especially in automotive interior components, flexible packaging, and consumer electronics. Companies such as BASF and Clariant have developed specialized biodegradable plastic modifiers to meet evolving industry needs.

By End-Use Industry, Packaging Industry Dominated the Biodegradable Plastic Additives Market in 2023 with a 40.25% Market Share

The Packaging segment dominated the biodegradable plastic additives market in 2023, primarily due to the shift toward sustainable packaging solutions in food & beverage, cosmetics, and pharmaceuticals. Major brands like PepsiCo, Nestlé, and McDonald's are investing in biodegradable packaging alternatives to reduce plastic waste. Regulatory mandates such as the European Green Deal and the U.S. Plastics Pact are further driving the adoption of biodegradable plastic additives in packaging applications.

Asia Pacific Region Dominated the Biodegradable Plastic Additives Market In 2023, Holding A 41.8% Market Share.

The dominance is driven by stringent government regulations, rapid industrialization, and a growing focus on sustainable solutions. Countries such as China, India, and Japan are actively investing in biodegradable plastic production to curb plastic pollution. The Chinese government’s ban on non-biodegradable plastic bags in major cities and India's single-use plastic ban in 2022 have significantly propelled market growth. Additionally, rising consumer awareness and corporate sustainability commitments are fueling the region’s demand for eco-friendly alternatives.

North America Emerged as the Fastest Growing Region in Biodegradable Plastic Additives Market with A Significant Growth Rate in The Forecast Period

The U.S. and Canada are leading the charge, driven by federal and state-level regulations promoting biodegradable alternatives. The U.S. Department of Agriculture (USDA) and Environmental Protection Agency (EPA) have launched multiple initiatives to support sustainable packaging and biodegradable materials. Additionally, companies such as Danimer Scientific and Novamont are expanding their production capacities to cater to the growing demand.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Biodegradable Plastic Additives Market Segmentation, By Polymer Type

8. Biodegradable Plastic Additives Market Segmentation, by Foam Type

9. Biodegradable Plastic Additives Market Segmentation, by Application

10. Biodegradable Plastic Additives Market Segmentation, by End-Use Industry

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practice

14. Conclusion

Buy Full Research Report on Biodegradable Plastic Additives Market 2024-2032 @ https://www.snsinsider.com/checkout/6083

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.