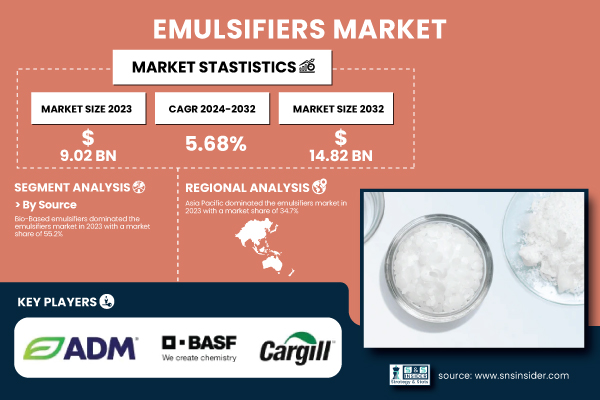

Austin, March 28, 2025 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that, “The Emulsifiers Market Size was valued at 9.02 Billion in 2023 and is expected to reach USD 14.82 Billion by 2032, growing at a CAGR of 5.68% over the forecast period of 2024-2032.”

Expanding Applications and Sustainability Drive Growth in the Emulsifiers Market Across Food, Cosmetics, and Pharmaceuticals

The emulsifiers market is growing rapidly due to increasing demand in food, cosmetics, and pharmaceuticals. Consumers' preference for clean-label and natural ingredients is driving the shift toward bio-based emulsifiers, supported by regulatory approvals. The U.S. FDA reports rising applications of lecithin in functional foods, while the EFSA approved new plant-based emulsifiers in 2023, boosting European market growth. Leading players like BASF SE and Cargill Inc. are investing in sustainable emulsifier production. In 2024, Unilever launched a new skincare line featuring naturally sourced emulsifiers, highlighting the cosmetic industry’s shift toward organic formulations. The pharmaceutical sector is also increasing emulsifier adoption in drug delivery systems. With strong regulatory backing, sustainability initiatives, and technological innovations, the emulsifiers market is poised for substantial growth over the next decade.

The US Emulsifiers Market Size was valued at 6.52 Billion in 2023 and is expected to reach USD 10.54 Billion by 2032, growing at a CAGR of 5.48% over the forecast period of 2024-2032.

The U.S. emulsifiers market is growing due to rising demand for clean-label food, sustainable cosmetics, and advanced pharmaceuticals. The FDA approved new emulsifiers in 2023, boosting innovation in functional foods and drug formulations. The AOCS reports increasing demand for plant-based lecithin, with Cargill and DuPont expanding bio-based production. Additionally, the PCPC highlights a shift toward natural emulsifiers in skincare, driving adoption in the cosmetics sector.

Download PDF Sample of Emulsifiers Market @ https://www.snsinsider.com/sample-request/6084

Key Players:

- Archer Daniels Midland Company (ADM) (Lecithin, Mono- and Diglycerides)

- BASF SE (Lutensol Nonionic Surfactants, Kolliphor Polyethylene Glycol Esters)

- Cargill, Incorporated (Lecithin, Mono- and Diglycerides)

- Clariant (Hostaphat Emulsifiers, Hostapon Surfactants)

- Corbion (PURAC Esters, PATIONIC Glycerol Esters)

- Croda International Plc (Tween Polysorbates, Span Sorbitan Esters)

- DuPont (Danisco Lecithin, DIMODAN Distilled Monoglycerides)

- Evonik Industries AG (TEGO Alkanol Emulsifiers, TOMAMINE Ethoxylates)

- Ingredion Incorporated (N-CREAMER Starch-based Emulsifiers, PURITY GUM Stabilizers)

- Kerry Group plc (ULTRALEC Lecithin, MYVEROL Distilled Monoglycerides)

- Lasenor Emul S.L. (Lecithin, Mono- and Diglycerides)

- Lonza Group (Glycerol Monostearate, Sorbitan Monostearate)

- Lubrizol Corporation (CARBOWAX Polyethylene Glycols, Glucamate Emulsifiers)

- Nouryon (ETHOMEEN Fatty Amine Ethoxylates, ARQUAD Quaternary Ammonium Compounds)

- Palsgaard A/S (Emulpals Cake Emulsifiers, Palsgaard Lecithin)

- Puratos Group (ACTIWHITE Egg White Replacers, SAPPHIRE Emulsifiers)

- Riken Vitamin Co., Ltd. (RIKEMAL Emulsifiers, RIKEN Lecithin)

- Stepan Company (STEPAN-MILD Surfactants, STEOL Anionic Surfactants)

- Taiyo Kagaku Co., Ltd. (SUNSOFT Lecithin, SUNMULSION Emulsifiers)

- Akkim Kimya (Akfat Emulsifiers, Akpol Emulsifiers)

Emulsifiers Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 9.02 Billion |

| Market Size by 2032 | USD 14.82 Billion |

| CAGR | CAGR of 5.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Bio-Based, Synthetic) •By Product Type (Lecithin, Ionic Emulsifiers, Fatty Acid-Based Emulsifiers, Ester-Based Emulsifiers, Alcohol-Based Emulsifiers, Others) •By Physical State (Solid, Liquid) •By Application (Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Agrochemicals, Oilfield Chemicals, Others) |

| Key Drivers | • Growing Usage of Emulsifiers in Industrial and Oilfield Applications Propels the Emulsifiers Market Expansion. |

If You Need Any Customization on Emulsifiers Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/6084

Global Regulatory Changes in Emulsifiers Market Drive Shift Toward Cleaner and Bio-Based Alternatives

- The U.S. FDA has approved several new emulsifiers in 2023 for food and pharmaceutical use, promoting cleaner formulations.

- In 2024, the European Chemicals Agency (ECHA) imposed stricter guidelines on synthetic emulsifiers, driving demand for bio-based alternatives.

- China’s National Medical Products Administration (NMPA) revised regulations for cosmetic emulsifiers, favoring naturally derived compounds.

- The Codex Alimentarius Commission updated international standards for emulsifier usage in processed foods, influencing global trade.

- The Indian Food Safety and Standards Authority (FSSAI) is reviewing policy updates on emulsifier inclusion in packaged foods.

By Source, Bio-Based Emulsifiers Dominated the Emulsifiers Market in 2023 with a 55.2% Market Share

Bio-based emulsifiers dominated the market in 2023, driven by increasing demand for sustainable and natural ingredients. Derived from plant-based sources like soy, sunflower, and palm, these emulsifiers are widely used in food, cosmetics, and pharmaceuticals due to their eco-friendly and non-toxic properties. Governments and regulatory bodies, such as the European Chemicals Agency (ECHA) and the U.S. FDA, are promoting the use of bio-based emulsifiers to reduce synthetic chemical usage. Leading companies like Cargill, BASF, and ADM are expanding their bio-based emulsifier portfolios to meet growing consumer preferences for clean-label products. The food industry, particularly in Europe and North America, is driving demand as consumers increasingly opt for natural, organic, and non-GMO ingredients in processed foods and beverages.

By Product Type, Lecithin Segment Dominated the Emulsifiers Market in 2023 with a 30.9% Market Share

Lecithin was the leading product type in 2023, owing to its multifunctional applications in food, pharmaceuticals, and cosmetics. Extracted primarily from soy and sunflower, lecithin acts as an excellent emulsifier, stabilizer, and dispersing agent. The rising demand for plant-based and non-GMO lecithin is driving market growth, especially in North America and Europe. According to the U.S. Soybean Export Council, global soy lecithin production increased by 12% in 2023, with a significant portion used in dairy alternatives, bakery products, and dietary supplements. Companies like ADM and Cargill are investing in lecithin production facilities to cater to the growing demand for organic and allergen-free emulsifiers, particularly in vegan food and clean beauty formulations.

By Application, Cosmetics & Personal Care Dominated the Emulsifiers Market in 2023 with a 38.7% Market Share

The cosmetics & personal care segment dominated the emulsifiers market in 2023, primarily driven by increasing consumer awareness of clean beauty trends and natural skincare products. Emulsifiers play a crucial role in stabilizing lotions, creams, and serums, enhancing their texture and absorption. With growing demand for bio-based and non-toxic emulsifiers, companies like L’Oréal and Unilever have introduced formulations incorporating plant-derived emulsifiers. Additionally, the rise in demand for multifunctional skincare products with natural emulsifiers has led to increased innovation in emulsification technologies. The Indian Beauty & Hygiene Association (IBHA) reported that organic emulsifiers saw a 20% increase in demand in 2023, especially in premium and luxury beauty brands, further accelerating market growth in this segment.

Asia Pacific Region Dominated the Emulsifiers Market In 2023, Holding a 34.7% Market Share.

Asia Pacific dominated the Emulsifiers market in 2023, driven by rapid industrialization, rising disposable income, and a growing population. The increasing consumption of processed foods, expanding personal care industries, and demand for bio-based emulsifiers contributed to the region’s leadership. Countries like China, India, and Japan are witnessing significant growth in food and cosmetic emulsifier applications due to changing consumer preferences. The China National Food Industry Association (CNFIA) reported a 15% rise in emulsifier usage in the food sector in 2023. Furthermore, government initiatives promoting sustainable manufacturing and investment in plant-based emulsifier production are accelerating regional growth.

North America Emerged as the Fastest Growing Region in Emulsifiers Market with A Significant Growth Rate in The Forecast Period

The North American region is emerging as the fastest-growing market for Emulsifiers in 2023, primarily due to the rising demand for clean-label and organic emulsifiers. The U.S. and Canada are leading the adoption of bio-based emulsifiers, driven by stringent FDA regulations and increasing consumer awareness. The U.S. Food Industry Association reported a 12% increase in plant-derived emulsifier consumption in packaged foods in 2023. Additionally, the pharmaceutical industry in North America is increasingly utilizing emulsifiers in drug formulations. Companies like BASF and Evonik are investing in advanced emulsifier technologies, further boosting regional growth.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Emulsifiers Market Segmentation, By Source

8. Emulsifiers Market Segmentation, by Product Type

9. Emulsifiers Market Segmentation, by Physical State

10. Emulsifiers Market Segmentation, by Application

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practice

14. Conclusion

Buy Full Research Report on Emulsifiers Market 2024-2032 @ https://www.snsinsider.com/checkout/6084

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.