Pune, April 03, 2025 (GLOBE NEWSWIRE) -- AI in Asset Management Market Size Analysis:

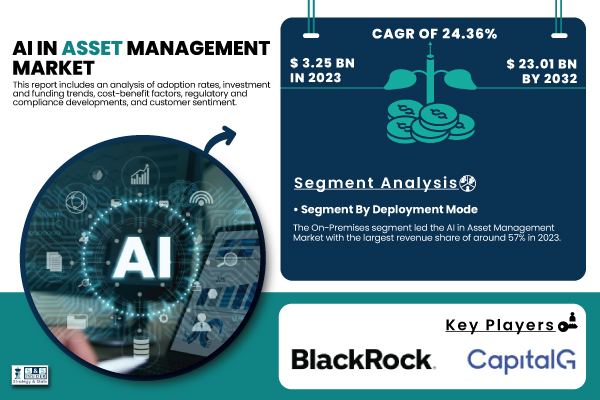

“The AI in Asset Management Market was valued at USD 3.25 billion in 2023 and is projected to reach USD 23.01 billion by 2032, growing at a CAGR of 24.36% between 2024 and 2032.”

Get a Sample Report of AI in Asset Management Market@ https://www.snsinsider.com/sample-request/5988

Major Players Analysis Listed in this Report are:

- Amazon Web Services, Inc. (Amazon SageMaker, AWS AI Services)

- BlackRock, Inc. (Aladdin, FutureAdvisor)

- CapitalG (Investments in AI-focused companies, Strategic AI partnerships)

- Charles Schwab & Co., Inc. (Schwab Intelligent Portfolios, AI-driven financial advice tools)

- Genpact (Cora Finance Analytics, AI-powered asset management solutions)

- Infosys Limited (Infosys Nia, AI-driven financial services solutions)

- International Business Machines Corporation (IBM Watson, IBM Cloud Pak for Data)

- IPsoft Inc. (Amelia, 1Desk)

- Lexalytics (Salience, Lexalytics Intelligence Platform)

- Microsoft (Azure AI, Microsoft Power BI)

- TABLEAU SOFTWARE, LLC (Tableau Desktop, Tableau Server)

- Next IT Corp. (Alme, AI-powered virtual assistants)

- S&P Global (Market Intelligence Platform, Kensho AI)

- Salesforce, Inc. (Einstein Analytics, AI-driven CRM solutions)

- FIS (FIS Asset Management Solutions, FIS Data Integrity Manager)

- ION Group (ION Treasury, ION Analytics)

- Synechron (Neo AI Platform, AI Data Science Accelerators)

- SAP SE (SAP Cash Application, SAP Leonardo)

- HighRadius (Autonomous Receivables, AI-powered Treasury Management)

- Axyon AI (Axyon IRIS, AI Investment Strategies)

- Upstart (AI-powered Lending Platform, Upstart Auto Retail)

- Capgemini SE (AI in Wealth Management Solutions, AI-powered Financial Services)

- BayCurrent Inc. (AI Consulting Services, AI-driven Financial Solutions)

- MGX Fund Management Limited (AI Investment Fund, Global AI Infrastructure Investment Partnership)

AI in Asset Management Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 3.25 Billion |

| Market Size by 2032 | USD 23.01 Billion |

| CAGR | CAGR of 24.36% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | • AI-powered analytics revolutionize asset management by enhancing decision-making, optimizing portfolios, predicting market trends, and minimizing risks. |

Do you have any specific queries or need any customization research on AI in Asset Management Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/5988

The market is growing due to rising demand for automation and sophisticated analytics in asset management, enabling companies to enhance decision-making and efficiency. AI-based solutions offer better portfolio management, risk evaluation, and predictive analysis, enhancing operational efficiency. The increasing use of AI in financial services and the necessity to handle complex assets and minimize human error are also driving market growth. Besides, as the financial sector competes to remain relevant, AI technologies hold enormous potential for innovation, particularly in investment strategy optimization, process streamlining, and client service improvement. The future of AI in asset management is characterized by promising growth in fintech and wealth management segments.

The U.S. AI in Asset Management Market was valued at USD 1.14 billion in 2023 and is projected to reach USD 8.19 billion by 2032, growing at a CAGR of 24.47% between 2024 and 2032.

The U.S. AI in Asset Management Market is growing at a fast rate due to the established presence of top-tier financial institutions, early adoption of AI, and rising investments in automation. The need for AI-based portfolio management, risk evaluation, and forecasting analysis is growing as companies aim to improve decision-making and operating efficiency. Moreover, regulatory endorsement for AI adoption is inclusive of machine learning and natural language processing improvements, the increased demand for fraud detection and algorithmic trading, as well as fueling market growth.

On-Premises Segment Leads AI in Asset Management Market, Cloud Segment Expected to Experience Fastest Growth

In 2023, the on-premises segment led the AI in Asset Management Market with around 57% of total revenue. It is fueled by the requirement for strong data security, regulatory requirements, and complete control over sensitive financial data. Financial institutions are inclined towards on-premises AI to counter cybersecurity threats and maintain compliance with stringent data protection regulations. It also allows for customizable AI models, easy integration with existing infrastructure, and better performance in sophisticated investment strategies.

The cloud-based AI market is expected to expand at a CAGR of 25.96% during the forecast period 2024-2032, driven by mounting need for cloud-based, cost-effective, and scalable AI solutions. Cloud AI allows for real-time data processing, cloud-based deployment, and ease of integration with advanced analytics. Continuous improvement in cloud security and compliance with regulations is also prompting financial institutions to deploy cloud-based AI, driving market growth.

Process Automation Segment Dominates AI in Asset Management Market, Data Analysis Segment Set for Fastest Growth

The automation of processes segment contributed to almost 29% of the revenue of the AI in Asset Management Market in 2023. The leadership is fueled by the increasing demand to optimize operational effectiveness, minimize human errors, and simplify workflows. Automation with AI maximizes critical processes like trade execution, portfolio rebalancing, and compliance monitoring, resulting in considerable cost savings. Financial institutions use automation to increase resource utilization, speed up decision-making, and maximize overall investment management effectiveness.

The segment of data analysis is anticipated to grow at the fastest CAGR of 27.07% from 2024 to 2032 with growing dependency on AI-powered insights for investment choices. Asset managers apply AI-powered analytics for market trend interpretations, investment risk forecasts, and portfolio performance optimizations. Accelerated application of big data, machine learning, and real-time analytics to financial choices is also increasing the growth of the segment.

Machine Learning Segment Leads AI in Asset Management Market, Natural Language Processing (NLP) Segment to Grow Fastest

In 2023, the machine learning segment captured the fastest revenue share of about 61% in the AI in Asset Management Market. Its leadership is fueled by its capacity to handle large datasets, identify market trends, and improve predictive analytics for investment plans. Machine learning streamlines portfolio management, automates risk evaluation, and enhances decision-making precision. Its application in quantitative analysis, fraud detection, and algorithmic trading further enhances its market dominance.

The NLP segment is anticipated to grow at the fastest CAGR of 26.03% between 2024 and 2032, driven by growing demand for AI-based sentiment analysis and robotic financial reporting. NLP facilitates real-time processing of financial news, earnings announcements, and market sentiment to help improve investment decisions. With asset managers demanding more insights from unstructured textual information, the implementation of NLP for financial analysis and risk measurement keeps growing.

AI in Asset Management Market Segmentation:

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Others

By Deployment Mode

- On-Premises

- Cloud

By Application

- Portfolio Optimization

- Conversational Platform

- Risk & Compliance

- Data Analysis

- Process Automation

- Others

Buy an Enterprise-User PDF of AI in Asset Management Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/5988

North America Leads AI in Asset Management Market, Asia Pacific Set for Fastest Growth

North America led the AI in Asset Management Market in 2023, accounting for approximately 50% of total revenue. It is led by the dominance of large financial institutions, early technology adoption, and a strong regulatory environment. It enjoys superior infrastructure, high AI-driven financial service investments, and increasing demand for automation. Also, the universal application of machine learning and predictive analytics further entrenches it in portfolio management.

The Asia Pacific region is expected to grow at the fastest CAGR of 27.11% during 2024-2032, spurred by the widespread use of AI in financial services and speedy digitalization. China, India, and Japan are majorly investing in AI-based financial technology to maximize investment plans and risk control. Growing retail investors and cloud-based AI products' growing demand further boost regional market growth.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. AI In Asset Management Market Segmentation, By Technology

8. AI In Asset Management Market Segmentation, By Deployment Mode

9. AI In Asset Management Market Segmentation, By Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Details of AI in Asset Management Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/ai-in-asset-management-market-5988

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.