Chicago, May 15, 2025 (GLOBE NEWSWIRE) -- The global multiple myeloma market is witnessing steady growth, fuelled by an aging population, rising disease prevalence, and continuous advancements in treatment. Multiple myeloma, a rare but aggressive cancer of plasma cells, often evolves from precursor conditions such as MGUS and SMM. According to the World Health Organization, nearly 188,000 new cases were diagnosed globally in 2022, accounting for approximately 1% of all cancers and 10% of blood cancers. With an average diagnosis age of 69 and a rapidly aging global population, the demand for effective therapies is set to rise substantially.

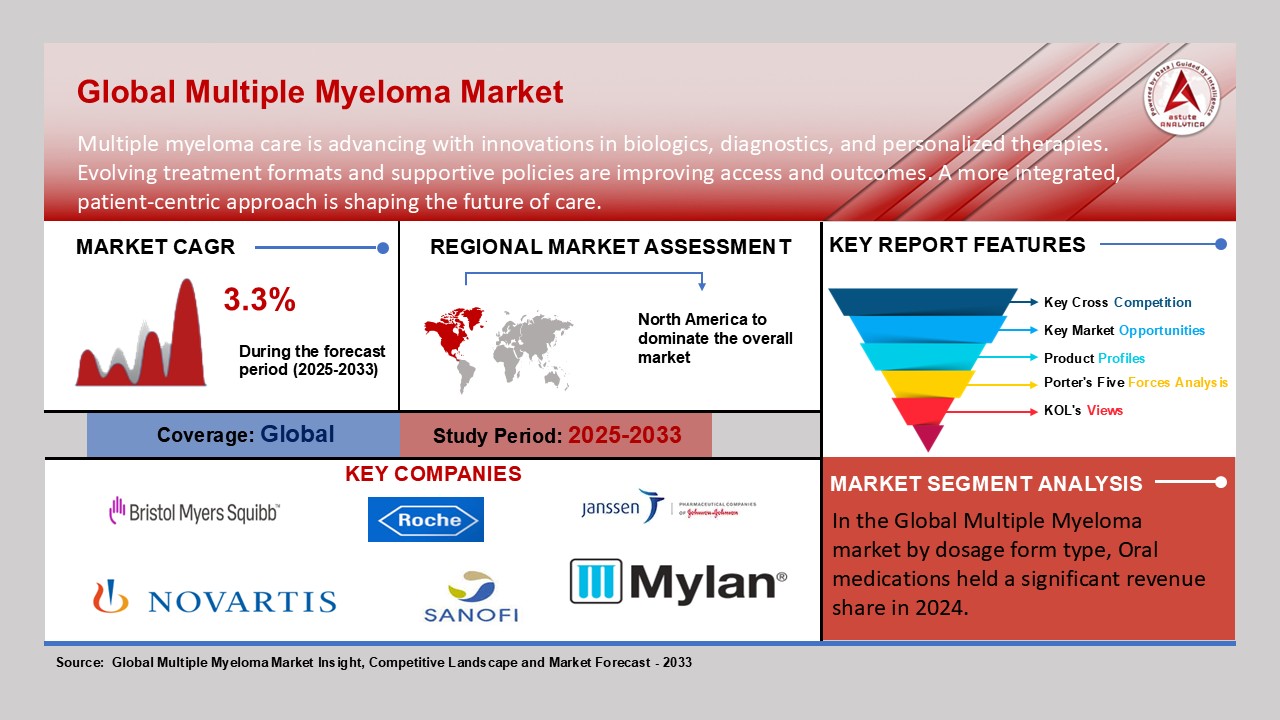

Market revenue is projected to grow from USD 22.6 billion in 2024 to USD 30.3 billion by 2033, reflecting a CAGR of 3.3%. This expansion is being driven by increased adoption of systemic treatments, pharmaceutical innovation, and biomarker-based diagnostics like serum M protein levels and del(17p) detection. By 2024, around 880,000 people worldwide were receiving treatment, many already undergoing second- or third-line therapies. Given the high prevalence in older adults, age-appropriate treatment strategies are becoming increasingly vital.

Download Sample Pages: https://www.astuteanalytica.com/request-sample/multiple-myeloma-treatment-market

Initial treatment typically involves induction therapy using combinations such as bortezomib, thalidomide, cyclophosphamide, dexamethasone, and monoclonal antibodies like daratumumab. Regimens like VCD and Dara-VTD are common, particularly among transplant-eligible patients. While early response rates are often strong, relapse remains a persistent challenge. Drugs like Isa-Pd are used in early relapse, and targeted therapies such as Venetoclax show promise, especially in patients with the t(11;14) translocation. For triple-class refractory cases, next-generation therapies like Abecma, Carvykti, Tecvayli, Talvey, and Elrexfio are providing new options and hope.

CAR T-cell therapies, particularly Abecma and Carvykti represent one of the most groundbreaking developments, employing genetically engineered immune cells to combat cancer. Roughly 80,000 patients between second and fourth lines of therapy may qualify for CAR T-cell treatment, with another 22,000 eligible in later stages. In some cases, these therapies have extended survival for five years or longer, depending on the disease stage and healthcare access.

Cost remains a significant barrier. CAR T-cell therapies like Carvykti can exceed USD 465,000 per treatment, while bispecific antibodies such as Tecvayli cost over USD 29,000 per cycle. Access is further limited by the small number of certified CAR T treatment centers only 311 in the United States, forcing many patients to travel, increasing both financial and logistical burdens. While private insurance may cover much of the cost, public programs like Medicare often fall short. More than half of insured patients still experience financial hardship, which can lead to delays or discontinuation of therapy.

As treatment options continue to advance, ensuring equitable access and affordability will be crucial for long-term sustainability and patient outcomes.

Key Findings in Multiple Myeloma Market

| Market Forecast (2033) | US$ 30.3 Billions |

| CAGR | 3.3% |

| Top Drivers | Rising Multiple Myeloma Incidence Amid Global Aging Trends |

| Top Trends | Emerging Potential in Targeted and Immune-Based Therapies |

| Top Challenges | High Cost of Advanced Therapies Continues to Limit Patient Access |

Next-Gen Advances: Immunotherapy and Precision Medicine Driving Multiple Myeloma Innovation

The treatment landscape for multiple myeloma (MM) is rapidly evolving, with CAR T-cell therapies and bispecific antibodies emerging as groundbreaking options. CAR T-cell therapies like idecabtagene vicleucel and ciltacabtagene autoleucel have shown impressive response rates, ranging from 73-98%, in relapsed or refractory patients. However, relapse remains a significant concern, as almost all patients eventually relapse, with about 50% doing so within 26.9 months. The key opportunity lies in enhancing the durability of CAR T-cell responses and combining them with other therapies to prolong remissions. Despite their potential, CAR T-cells are still not widely available as off-the-shelf treatments, limiting accessibility.

On the other hand, bispecific antibodies targeting BCMA and GPRC5D are emerging as effective off-the-shelf alternatives, with drugs like teclistamab showing response rates above 60% in patients with refractory MM. While these therapies offer great promise, issues such as toxicity and antigen escape remain challenges that need to be addressed. Combining bispecific antibodies with other therapies could enhance their effectiveness, particularly for advanced-stage multiple myeloma, opening new avenues for more durable and impactful treatments.

Regional Dynamics: Navigating the Global Evolution of Multiple Myeloma Treatment.

The global multiple myeloma market is expanding rapidly, driven by regional factors such as healthcare advancements, increasing treatment availability, and varying market dynamics across different geographies. North America, Europe, and Asia-Pacific are the primary drivers of this growth, each contributing uniquely to the market's development.

North America remains at the forefront of the global multiple myeloma market, driven by a high disease prevalence, advanced healthcare infrastructure, and the early adoption of innovative therapies. In the United States alone, an estimated 35,780 new cases of multiple myeloma are expected in 2024, including 19,520 males and 16,260 females. In Canada, approximately 4,100 individuals are projected to be diagnosed with the disease, and 1,750 are expected to succumb to it. The region is also home to major pharmaceutical companies like Johnson & Johnson, Amgen, and Bristol Myers Squibb, which are heavily investing in research, development, and clinical trials. Additionally, advocacy groups and pharmaceutical education programs are crucial in increasing awareness and promoting early diagnosis of the disease.

Europe remains a strong player in the global multiple myeloma market, supported by well-established healthcare systems and significant EU-funded research initiatives focused on oncology. Countries like Germany, the UK, and France are seeing increased incidence rates, which fuel demand for treatments. However, the region faces challenges such as high drug prices and longer approval times compared to North America, which can limit faster market expansion.

Asia-Pacific is the fastest-growing region in the multiple myeloma market, driven by increased awareness, better access to treatments, and expanding research and development efforts. Japan and India are witnessing a surge in clinical trials and the introduction of new therapies for multiple myeloma. In Japan, the disease has an annual incidence of approximately 5 new cases per 100,000 people and leads to around 4,000 deaths each year. Notably, Japan approved Sarclisa (isatuximab) in February 2025, highlighting the country's commitment to expanding treatment options. This regional growth reflects the increasing focus on tackling the rising burden of multiple myeloma in Asia.

The Middle East & Africa account for a smaller share of the global multiple myeloma market, mainly due to healthcare disparities and limited treatment infrastructure in many African nations. However, countries like Saudi Arabia, the UAE, and South Africa are making strides by investing in healthcare development and increasing access to cancer treatments, showing potential for future growth in the region.

Several key players in the pharmaceutical industry, including Takeda Pharmaceutical Company Limited, Mylan N.V., Novartis AG, Teva Pharmaceutical Industries Ltd., Bristol Myers Squibb Company, Arcellx, Regeneron Pharmaceuticals, Inc., Cartesian Therapeutics, BeiGene, AbbVie Inc., Roche (F. Hoffmann-La Roche Ltd), Amgen Inc., ONO PHARMACEUTICAL CO., LTD., Janssen Pharmaceuticals, Inc., Genentech, Inc. (a subsidiary of Roche), Celgene Corporation (part of Bristol Myers Squibb), Sanofi, and Karyopharm Therapeutics Inc., are advancing treatments in the field of multiple myeloma. These companies are making significant strides in developing therapies that aim to improve patient outcomes and expand treatment options.

For instance, The European Commission granted Regeneron’s Lynozyfic (linvoseltamab) conditional approval for relapsed/refractory multiple myeloma after three or more therapies. In the LINKER-MM1 trial, Lynozyfic showed a 71% response rate and 50% complete response, with a 29-month median duration of response. It is the first BCMAxCD3 bispecific with response-adapted monthly dosing, offering convenience for heavily pretreated patients. Severe CRS and ICANS were rare.

AstraZeneca expanded its cell therapy portfolio by acquiring Belgian biotech EsoBiotec for up to $1 billion. EsoBiotec’s in-vivo CAR-T platform provides off-the-shelf therapies for multiple myeloma, adding a faster and more cost-effective approach to AstraZeneca’s portfolio, which includes its $1.2 billion 2023 acquisition of Gracell Biotechnologies.

Opna Bio’s oral EP300/CBP bromodomain inhibitor, OPN-6602, received FDA Orphan Drug Designation for relapsed/refractory multiple myeloma. In Phase 1 trials, OPN-6602 demonstrated promising results in combination with dexamethasone, pomalidomide, and mezigdomide, with potential benefits in lower toxicity and improved efficacy. The designation includes tax credits, fee waivers, and seven years of market exclusivity.

In December 2024, GSK reported a 42% reduction in death risk with its Blenrep combination therapy in relapsed/refractory multiple myeloma, with patients projected to live nearly three years longer than those receiving standard care. GSK has refiled for FDA approval, with a decision expected by July 2025, and received priority review in China. The drug, once withdrawn from the U.S. market, is poised for a comeback, with peak sales projected over $3.99 billion.

Need Custom Data? Let Us Know: https://www.astuteanalytica.com/ask-for-customization/multiple-myeloma-treatment-market

Future Outlook: Evolving the Multiple Myeloma Treatment Landscape

The multiple myeloma treatment market is poised for significant evolution in the coming years, driven by continuous advancements in dosage forms, diagnostic tools, and personalized therapies. Oral medications continue to lead the market due to their convenience and patient adherence benefits. At the same time, injectable treatments, such as CAR T-cell therapies and monoclonal antibodies are expanding rapidly, supported by their high efficacy in targeted treatment. However, these biologics are often associated with high costs, and ongoing research aims to develop more accessible and patient-friendly alternatives.

Research and development are particularly focused on addressing relapsed and refractory cases, which remain a major challenge in clinical management. The rise of online pharmacies is also contributing to increased accessibility and convenience for patients, supporting broader treatment adoption.

Genetic testing is expected to play an increasingly central role in treatment decisions, with high-throughput sequencing and AI-driven diagnostic tools becoming essential components of personalized care. The growth of multiplex biomarker platforms will further enable precise patient stratification, allowing clinicians to tailor therapies to individual genetic profiles and disease characteristics.

A shift toward preventive care will increase demand for early-stage detection tools, especially for precursor conditions like MGUS (monoclonal gammopathy of undetermined significance) and SMM (smoldering multiple myeloma), which have historically been difficult to manage. These innovations will also drive growth in the diagnostics segment, improving risk assessment and patient outcomes.

Government policies and changing reimbursement frameworks will play a crucial role in defining the future of multiple myeloma treatment. Increased funding for research and clinical development is driving progress in next-generation therapies, such as bispecific antibodies, antibody-drug conjugates, and innovative proteasome inhibitors.

By 2030, the multiple myeloma treatment landscape will be shaped by a comprehensive approach that combines targeted therapies, advanced biologics, and precision diagnostics. Personalized, early-stage intervention is expected to become the standard of care, supported by improved healthcare access, affordability, and infrastructure.

Key Competitors

- Takeda Pharmaceutical Company Limited

- Mylan N.V.

- Novartis AG

- Teva Pharmaceutical Industries Ltd.

- Bristol Myers Squibb Company

- Arcellx

- Regeneron Pharmaceuticals, Inc.

- Cartesian Therapeutics

- BeiGene

- AbbVie Inc.

- Roche (F. Hoffmann-La Roche Ltd)

- Amgen Inc.

- ONO PHARMACEUTICAL CO., LTD.

- Janssen Pharmaceuticals, Inc.

- Genentech, Inc. (a subsidiary of Roche)

- Celgene Corporation (part of Bristol Myers Squibb)

- Sanofi

- Karyopharm Therapeutics Inc.

- Others

Global Multiple Myeloma Treatment Market Segmentation (2024–2032):

By Drug Class:

- Alkylating Agent

- Melphalan (generic)

- Cyclophosphamide (generic)

- Bendamustine (Treanda)

- Melphalan flufenamide (meflufen; Pepaxto)

- Proteasome Inhibitors (specify names)

- Bortezomib (Velcade)

- Carfilzomib (Kyprolis)

- Ixazomib (Ninlaro)

- Immunomodulatory Drugs (IMiDs)

- Thalidomide (Thalidomid/generic)

- Lenalidomide (Revlimid)

- Pomalidomide (Pomalyst/Imnovid)

- Monoclonal Antibodies

- Daratumumab (Darzalex)

- Isatuximab (Sarclisa)

- Elotuzumab (Empliciti)

- Nuclear Export Inhibitors

- Selinexor (Xpovio)

- Antibody Drug Conjugate

- Belantamab mafodotin-blmf (Blenrep)

- CAR T Cell

- Idecabtagene vicleucel (ide-cel; Abecma)

- Ciltacabtagene autoleucel (cilta-cel; Carvykti)

- Steroids

- Prednisone (generic)

- Dexamethasone (generic)

- Chemotherapy

- Histone Deacetylase (HDAC) Inhibitors

- Panobinostat (Farydak)

- Bispecific Antibodies

- Teclistamab-cqyv (Tecvayl)

- Elranatamab-bcmm (Elrexfio)

- Linvoseltamab (Lynozyfic)

- Talquetamab-tgvs (Talvey)

By Disease Stage:

- Newly Diagnosed

- Relapsed/Refractory

By Dosage Form:

- Oral

- Injectables

- Others

By Distribution Channel:

- Offline Channel

- Hospital Pharmacies

- Speciality Retail Pharmacies

- Online pharmacies

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Need More Info? Ask Before You Buy: https://www.astuteanalytica.com/inquire-before-purchase/multiple-myeloma-treatment-market

About Astute Analytica

Astute Analytica is a global market research and advisory firm providing data-driven insights across industries such as technology, healthcare, chemicals, semiconductors, FMCG, and more. We publish multiple reports daily, equipping businesses with the intelligence they need to navigate market trends, emerging opportunities, competitive landscapes, and technological advancements.

With a team of experienced business analysts, economists, and industry experts, we deliver accurate, in-depth, and actionable research tailored to meet the strategic needs of our clients. At Astute Analytica, our clients come first, and we are committed to delivering cost-effective, high-value research solutions that drive success in an evolving marketplace.

Contact Us:

Astute Analytica

Phone: +1-888 429 6757 (US Toll Free); +91-0120- 4483891 (Rest of the World)

For Sales Enquiries: sales@astuteanalytica.com

Website: https://www.astuteanalytica.com/

Follow us on: LinkedIn | Twitter | YouTube