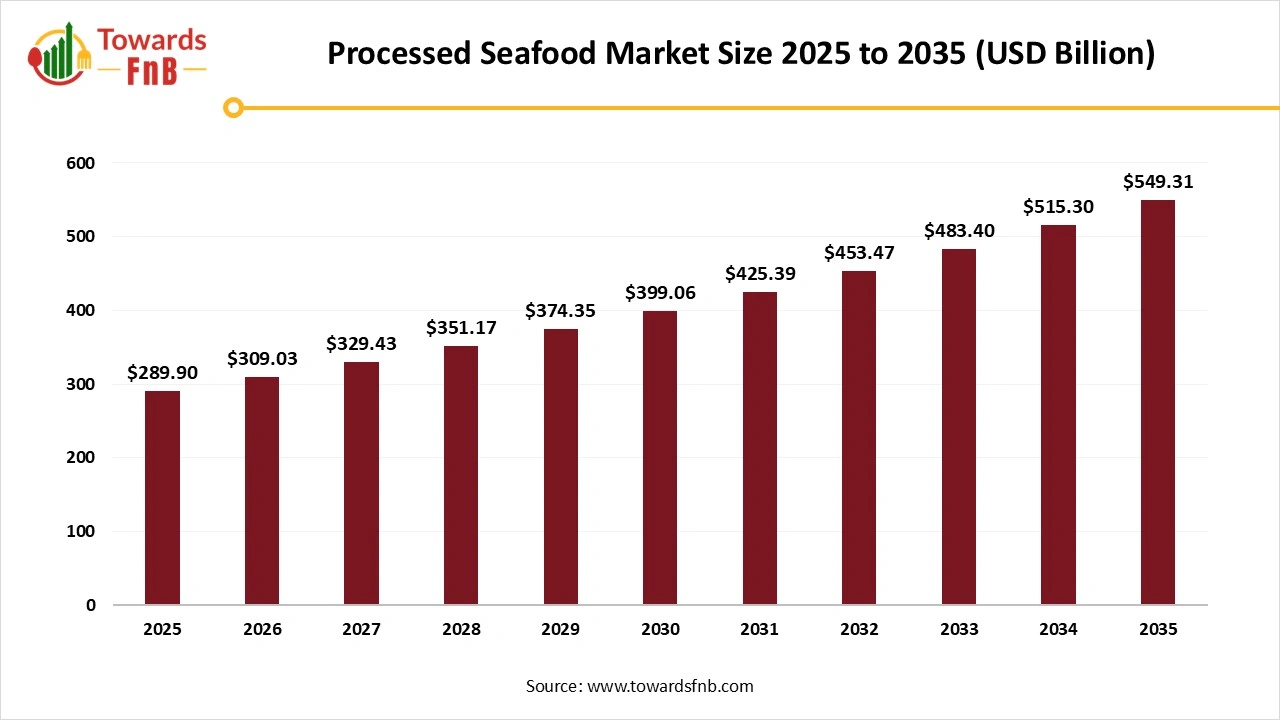

Ottawa, Dec. 09, 2025 (GLOBE NEWSWIRE) -- The global processed seafood market size stood at USD 271.95 billion in 2024 and is predicted to increase from USD 289.90 billion in 2025 to reach around USD 549.31 billion by 2035, according to a report published by Towards FnB, a sister firm of Precedence Research. The report highlights that rising adoption of frozen, canned, and ready-to-eat seafood across both emerging and developed markets continues to strengthen year-on-year demand.

The market is expected to grow due to high demand for convenient, high-protein, and time-saving food options while maintaining high nutritional value. The market is also growing due to the easy availability of such food options across multiple platforms.

“Consumers are prioritizing convenient, clean-label seafood options without compromising nutrition. This shift is accelerating the adoption of frozen, canned, and ready-to-eat seafood globally,” said Vidyesh Swar, Principal Consultant at Towards FnB.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5937

Key Highlights of the Processed Seafood Market

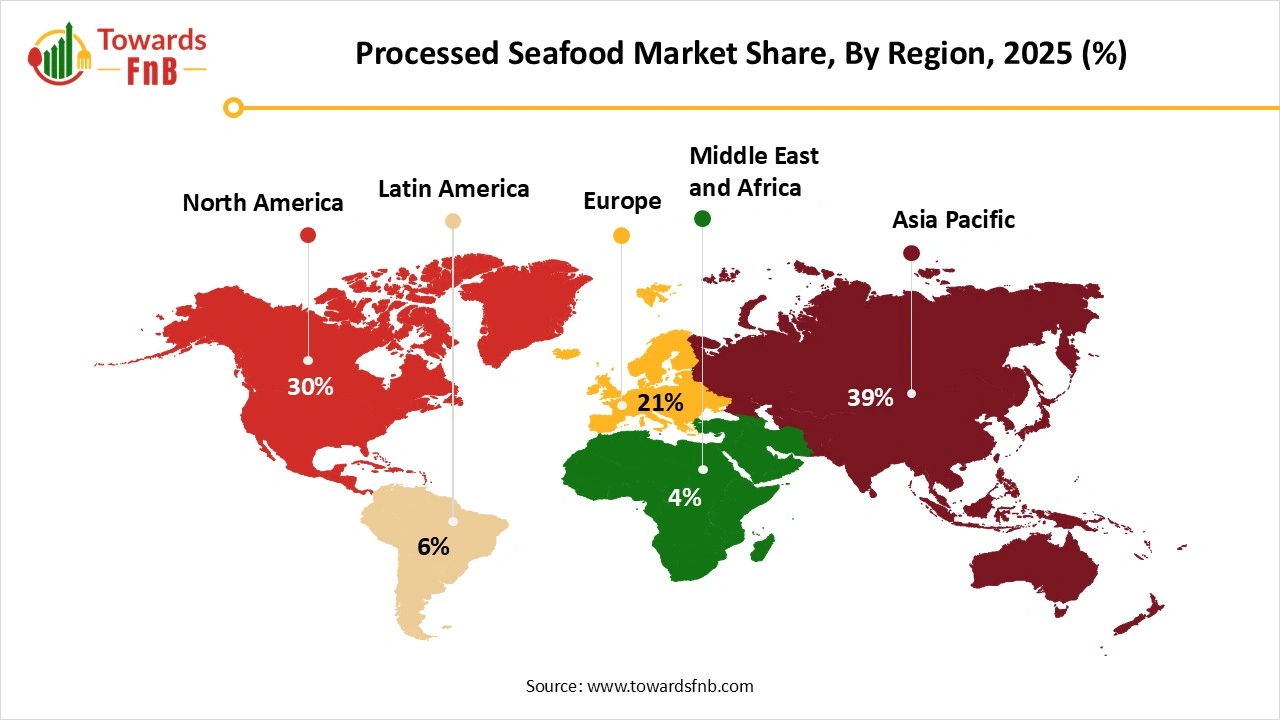

- By region, the Asia Pacific led the processed seafood market in 2025, whereas North America is expected to grow in the foreseeable period.

- By species, the fish segment led the processed seafood market in 2025, whereas the shrimp segment is expected to grow in the expected timeframe.

- By product, the frozen seafood segment led the market in 2025, whereas the canned seafood segment is expected to grow in the foreseeable period.

- By distribution channel, the supermarkets or hypermarkets segment led the processed seafood market in 2025, whereas the online retail segment is expected to grow in the foreseeable period.

High Demand for Convenient, Protein-Rich Options is Beneficial for Market Growth

The processed seafood market is experiencing significant growth driven by high demand for convenient, high-protein options among consumers with hectic lifestyles. The market also observes growth due to the availability of ready-to-eat and ready-to-cook options, which help save consumers' time and energy with busy lifestyles. The market involves storing seafood for a longer shelf life through processes such as salting, smoking, drying, freezing, canning, or adding preservatives.

Such methods help enhance the shelf-life of seafood while maintaining its nutritional value. Hence, it helps to propel the growth of the processed seafood industry. Such methods also ensure that the nutritional qualities of the food options are intact. Hence, it further enhances market growth. The availability of such processed options across various platforms, including retail and online retail stores, further enhances demand and supports market growth.

Technological Advancements are helpful for the Growth of the Processed Seafood Market

Technological advancements that enhance shelf life and maintain the nutritional quality of processed seafood help drive market growth. Use of non-thermal techniques such as High Pressure Processing (HPP) and plasma technology helps enhance the shelf-life of processed seafood while maintaining its nutritional qualities. Positive changes in supply chain management, quality assurance, and sustainability management are also driving market growth through the Fourth Industrial Revolution (Industry 4.0). Various other technological processes, such as smart packaging, AI, ML, and intelligent sensors, also help enhance market growth and build consumer trust.

Artificial intelligence is changing how processed seafood is sourced, handled, and delivered, bringing greater precision and transparency to a category that depends on freshness and strict safety controls. At the sourcing level, AI systems analyze satellite data, vessel tracking signals, and ocean temperature patterns to verify legal fishing activity and identify catch zones for species such as tuna, salmon, shrimp, and mackerel. These tools help processors secure traceable, responsibly harvested seafood and reduce exposure to illegal, unreported, and unregulated fishing.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/processed-seafood-market

New Trends in the Processed Seafood Market

- Higher demand for eco-friendly and sustainable sourcing of processed seafood is one of the major factors for the growth of the market.

- Higher demand for convenient and seafood meal kits, and ready-to-eat processed seafood options, also helps to fuel the growth of the market.

- Higher demand for low-calorie, protein-rich, and omega-3-rich products is another major factor driving the market's growth.

Recent Developments in the Processed Seafood Market

- In October 2025, Highland Group launched its exclusive seafood brand Aqua Fair in collaboration with Lulu Group. The grand launch was held during the World Food Expo in New Delhi.

- In August 2025, Seafood Expo Global/Seafood Processing Global announced the launch of its aquaculture innovation pavilion. The pavilion is expected to debut during the next edition of the trade show from 21st to 23rd April 2026, at Fira de Barcelona’s Gran Vía venue in Barcelona, Spain.

Top Products in the Processed Seafood Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or Consumer Segments | Representative Producers or Brands |

| Canned Tuna and Canned Fish Products | Shelf-stable seafood processed through canning with oil, brine, or sauces. | Canned tuna, sardines, mackerel, salmon | Mass retail, meal prep, affordable protein | Thai Union (Chicken of the Sea), Bumble Bee, Rio Mare |

| Frozen Fish Fillets | Flash-frozen fillets are used worldwide for convenience and long shelf life. | Cod fillets, pollock fillets, salmon fillets, tilapia fillets | Retail freezers, foodservice | Trident Seafoods, High Liner, Mowi |

| Breaded and Battered Seafood | Coated seafood is designed for quick frying or baking. | Breaded shrimp, fish sticks, battered fish fillets | QSR, frozen retail, family meals | Gorton’s, High Liner, Young’s Seafood |

| Smoked Seafood | Seafood is processed using cold or hot smoking to enhance flavor and preserve it. | Smoked salmon, smoked trout, smoked mackerel | Gourmet retail, delis, brunch menus | Mowi, Ducktrap, SeaBear |

| Surimi and Imitation Seafood Products | Processed fish protein formulated into imitation crab and seafood analogues. | Imitation crab sticks, surimi flakes, kani kama | Sushi, salads, seafood substitutes | Trident Seafoods, TransOcean, Vici |

| Ready-to-Eat Seafood Meals | Fully cooked seafood-based meals requiring no preparation. | Tuna salads, salmon bowls, mixed seafood meals | Convenience retail, lunch kits | Bumble Bee Ready Meals, private label seafood bowls |

| Marinated and Seasoned Seafood | Ready to cook seafood infused with herb, spice, or sauce blends. | Garlic herb salmon, teriyaki fish fillets, chili lime shrimp | Retail, meal kits, home cooking | Aqua Star, High Liner premium lines |

| Frozen Shrimp Products | Raw or cooked shrimp processed for freezing. | Peeled deveined shrimp, breaded shrimp, cooked shrimp | Foodservice, frozen retail, export | Thai Union, CP Foods, Pacific Seafood |

| Canned Shellfish and Specialty Seafood | Shelf-stable seafood products beyond tuna and sardines. | Canned octopus, canned squid, canned mussels, anchovies | Gourmet retail, ethnic markets | Vigo, La Brújula, Ortiz |

| Seafood Sausages and Value-Added Seafood | Seafood-based sausages and processed protein items. | Fish sausages, shrimp sausages, seafood patties | Health-conscious consumers, school programs | Nissui, Maruha Nichiro |

| Seafood Snacks and Jerky | Dried or seasoned seafood designed as protein snacks. | Salmon jerky, squid strips, fish chips | High protein snack markets, Asian retail | Alaska Smokehouse, Taokaenoi |

| Fermented Seafood Products | Traditional and specialty seafood are produced by fermentation. | Fish sauce base, fermented anchovy pastes | Ethnic cuisines, foodservice | Thai fish sauce makers, Korean seafood fermenters |

| Pickled and Brined Seafood | Seafood preserved in vinegar or brine. | Pickled herring, pickled mussels | European and Nordic markets | Abba Seafood, King Oscar |

| Seafood-Based Soups and Broths | Ready to consume liquid or concentrated seafood broths. | Clam chowder cans, lobster bisque, fish stock | Meal kits, retail soups, and restaurants | Campbell’s seafood soups, private label broths |

| Sushi Ready and Sashimi Grade Packaged Seafood | Pre-cut or pre-portioned seafood designed for retail sushi bars. | Sashimi salmon, tuna portions, sushi seafood kits | Retail sushi bars, home sushi segments | True World Foods, North Coast Seafoods |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5937

Processed Seafood Market Dynamics

What Are the Growth Drivers of the Processed Seafood Market?

The market is observed to grow significantly due to high demand for convenient options that are easy and quick to prepare. Such options are essential for consumers with hectic lifestyles, further fueling market growth. The market also sees growth as such options are high in protein, which is essential for consumers given their various benefits. Technological advancements help maintain the shelf life and nutritional quality of various seafood options. Hence, such options further propel market growth. Factors such as rising disposable incomes, rapid urbanization, and other similar segments further fuel the market's growth.

Challenge

Overfishing and Depletion Are Hampering the Market’s Growth

Overfishing and depletion are among the major restraints on the market's growth. Issues such as food web disruptions, biodiversity loss, poverty in coastal areas, and higher fish prices also constrain market growth. Such issues hamper the supply chain and harm fish reproduction, while also risking the species. Hence, these factors collectively hamper the market's growth.

Opportunity

Convenient and Nutritional Options Are Helpful for the Industry’s Growth

Higher demand for convenient, nutritious seafood options among consumers with hectic lifestyles is a major opportunity for market growth. Such options are available in ready-to-cook and ready-to-eat forms. They can be easily reheated and consumed, which is helpful for consumers who want a nutritious meal while they are outdoors or after wrapping up a hectic day with no time to cook a proper meal. Such options are also helpful for avoiding unhealthy and junk food, which are highly lucrative for consumers with a time crunch. Hence, such factors aid the market’s growth and offer an ideal opportunity to expand globally.

Processed Seafood Market Regional Analysis

Asia Pacific Led the Processed Seafood Market in 2025

Asia Pacific led the processed seafood market in 2025 due to higher demand for convenient, nutritious seafood options, thereby enhancing its growth. Growing disposable income, rapid urbanization, and higher demand for nutritional options are also major factors driving market growth.

The availability of advanced cold storage systems is essential for the market, and the storage of processed seafood is another major factor driving market growth in the region. China has a major contribution to the market's growth, as the country is one of the largest exporters of processed seafood globally. Factors such as the country's high demand for convenient and protein-rich options also help propel the market’s growth.

North America Is Expected to Grow in the Foreseen Period

North America is expected to be the fastest-growing region over the forecast period due to high demand for convenient options. Higher demand for ready-to-cook and ready-to-eat options is another major factor for the market’s growth. Demand for low-fat, high-protein, and Omega-3 options is another major factor driving market growth. The US has a major contribution to the region's market growth due to high demand for protein-rich options such as fish, shrimp, and tuna. The availability of such options on various platforms also helps fuel the market’s growth in the foreseeable period.

Europe Is Observed to Have a Notable Growth in the Foreseeable Period

Europe is observed to have notable growth in the processed seafood market due to improving regional aquaculture, improved cold-chain logistics, and higher demand for premium seafood options. Such options are high in protein and omega-3 fatty acids, further fueling market growth. Higher demand for ready-to-cook and ready-to-eat options is another major factor driving market growth. Countries such as Spain, France, and Portugal have the highest contribution to the region's market growth, with Spain the strongest, driven by higher demand for convenient, protein-rich options among consumers in the region.

Trade Analysis of the Processed Seafood Market

Market snapshot & recent trends

- Canned tuna is the dominant product group within processed fish, accounting for roughly 40–45% of HS-1604 trade by value in recent years.

- China, Thailand, and Ecuador are among the largest exporters of prepared/preserved tuna and processed seafood by value and volume; Thailand and Ecuador lead in canned tuna exports while China remains a major processed-seafood supplier overall.

- Global processed-seafood export values dipped in 2023 (value declines and shipment-count volatility were reported), reflecting tight raw-material supplies, price movements, and logistical disruptions following the 2022–2023 market shocks.

- Major importer markets for processed seafood include the United States, Japan, and key EU countries (Italy, Spain, UK), which together account for a large share of HS-1604 import value.

Top Exporters (supply hubs)

- Thailand: world leader in canned tuna processing and exports to retail markets worldwide.

- Ecuador: a major tuna exporter focused on canned/processed tuna lines to North America and Europe.

- China: large, diversified processed-seafood exporter (canned/preserved fish, ready meals, and processed crustaceans) and a major global supplier by shipment counts.

- Spain/EU exporters (Spain, Portugal, Norway for salmon processing): significant suppliers of premium processed lines (sardines, mackerel, smoked salmon) to EU and global retail channels.

Regulatory, sustainability & quality constraints

- Sanitary and veterinary approvals: processed seafood exporters must meet importer sanitary, residue and HACCP requirements; plant listings and certificates are required for many buyers.

- IUU (Illegal, Unreported and Unregulated) fishing controls & traceability: increasing importer enforcement (catch certificates, electronic traceability) affects which origins can access premium markets.

- Sustainability certification (MSC, ASC) and policy screens: buyers and public procurement increasingly require Marine Stewardship Council (MSC) or Aquaculture Stewardship Council (ASC) certification, or equivalent proof, for certain product lines, thereby shaping exporter competitiveness.

- Trade remedies & sanitary bans: anti-dumping probes, country-level import restrictions or sanitary suspensions (disease outbreaks) can abruptly alter flows.

Government initiatives shaping trade

- Fisheries management & stock recovery programmes: quota setting, fleet regulation and vessel monitoring systems aim to stabilise catches and secure sustainable export supply.

- Export promotion & processing support: origin governments (Thailand, Ecuador, Norway, EU member states) subsidise cold-chain upgrades, processing upgrades, and sanitary audits to expand market access.

- Traceability / catch-certification adoption: projects to implement electronic catch documentation and traceability are increasingly required by importing markets to combat IUU fishing and ensure market eligibility.

Processed Seafood Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 6.6% |

| Market Size in 2026 | USD 309.03 Billion |

| Market Size in 2027 | USD 329.43 Billion |

| Market Size by 2035 | USD 549.31 Billion |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | North America |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Processed Seafood Market Segmental Analysis

Species Analysis

The fish segment led the processed seafood market in 2025 due to its nutritional factors. Fishes are low in fat, high in protein, and rich in omega-3. Hence, they are highly in demand among consumers in various forms. Improved cold-chain management, logistics, and advanced storage facilities also help fuel the market's growth. Hence, such factors help enhance market growth.

The shrimp segment is expected to grow over the forecast period due to high demand for convenience, high-protein options, and versatile ingredients, thereby fueling the market’s growth. Innovation in aquaculture and the availability of premium shrimps with long shelf-lives are also major factors driving the market's growth in the foreseeable period. Shrimps are nutrient-dense, high in protein, and low in calories, further fueling the growth of the processed seafood market in the foreseeable period.

Product Analysis

The frozen segment led the processed seafood market in 2025 due to its convenience, providing consumers with nutritious, protein-packed seafood options with extended shelf life. The segment focuses on maintaining shelf life and nutritional quality across a range of seafood options, further fueling market growth. Hence, the segment makes a major contribution to market growth. The segment also observes growth driven by technological innovations such as advanced cold-chain logistics, freezing technology, and vacuum-sealed packaging, which help propel the market’s growth.

The canned seafood segment is expected to grow over the foreseeable period due to high demand for a balance between convenience and nutritional value. Canned seafood is high in protein, omega-3, and other nutritional values with an extended shelf-life. Hence, the segment is expected to grow in the forecast period. Such options can be easily prepared in less time and are ideal for consumers with a hectic lifestyle, thereby further propelling the market’s growth.

Distribution Channel Analysis

The supermarket/hypermarket segment dominated in 2025 due to their ideal locations near residential areas, enabling consumers to shop for desired products with ease. Such stores offer a wide variety of products across dedicated sections, further fueling market growth and providing convenience for consumers. Such stores also feature an array of newly launched products, with detailed information and discounted prices. Hence, such attractive pointers also help to aid the growth of the segment.

The online retail segment is expected to grow in the foreseeable future due to the platform's convenience, which is beneficial for market growth. Online platforms have a wide product portfolio, ranging from newly launched to innovative offerings across different categories. Hence, it enables consumers to shop smartly, further fueling market growth. Such platforms also provide lucrative discounts to consumers, further fueling enhanced shopping.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Strategic Profiles of Leading Companies in the Processed Seafood Sector

- Austevoll Seafood ASA: Austevoll Seafood ASA is a leading global seafood company based in Norway, operating across fishing, aquaculture, and processing. The company is known for its strong portfolio in pelagic fish, sustainable operations, and extensive export networks across Europe, Africa, and Asia.

- Aquachile: AquaChile is one of the world’s largest salmon producers, specializing in high-quality farmed salmon and trout products. With advanced aquaculture practices and global distribution, the company plays a key role in meeting rising demand for premium processed seafood.

- The Union Frozen Products: The Union Frozen Products is a major seafood exporter focused on frozen fish and value-added seafood items. The company leverages modern processing facilities and a robust cold-chain network to deliver high-quality seafood to global retail and foodservice clients.

- Sajo Industries: Sajo Industries is a South Korean seafood and food processing company known for its extensive range of canned, frozen, and ready-to-eat seafood products. With strong innovation capabilities and international trade presence, Sajo remains a key player in the global seafood supply chain.

- Tropical General Investments Nigeria Ltd: Tropical General Investments (TGI Group) operates in diversified sectors, including agriculture and food processing, with a growing footprint in processed seafood. The company focuses on affordable, high-quality protein solutions tailored to emerging markets in Africa and beyond.

- China National Fishery Corporation (CNFC): CNFC is one of China’s largest state-owned enterprises in deep-sea fishing, aquaculture, and seafood processing. With a global fishing fleet and large-scale processing operations, CNFC plays a vital role in supplying both domestic and international seafood markets.

- Trident Seafoods: Trident Seafoods is a leading U.S.-based seafood company specializing in wild-caught Alaskan seafood, including salmon, pollock, and cod. The company is recognized for its vertically integrated operations, sustainable sourcing practices, and strong retail and foodservice presence.

- High Liner Foods: High Liner Foods is a prominent North American processor and marketer of frozen seafood products for retail and foodservice channels. With a diverse product portfolio and a focus on innovation and responsible sourcing, the company remains a top supplier in the frozen seafood segment.

Segment Covered in the Report

By Species

- Fish

- Molluscs

- Tuna

- Shrimps

- Crabs

- Others

By Product

- Frozen Seafood

- Canned Seafood

- Smoked Seafood

- Dried Products

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Retail

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5937

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market