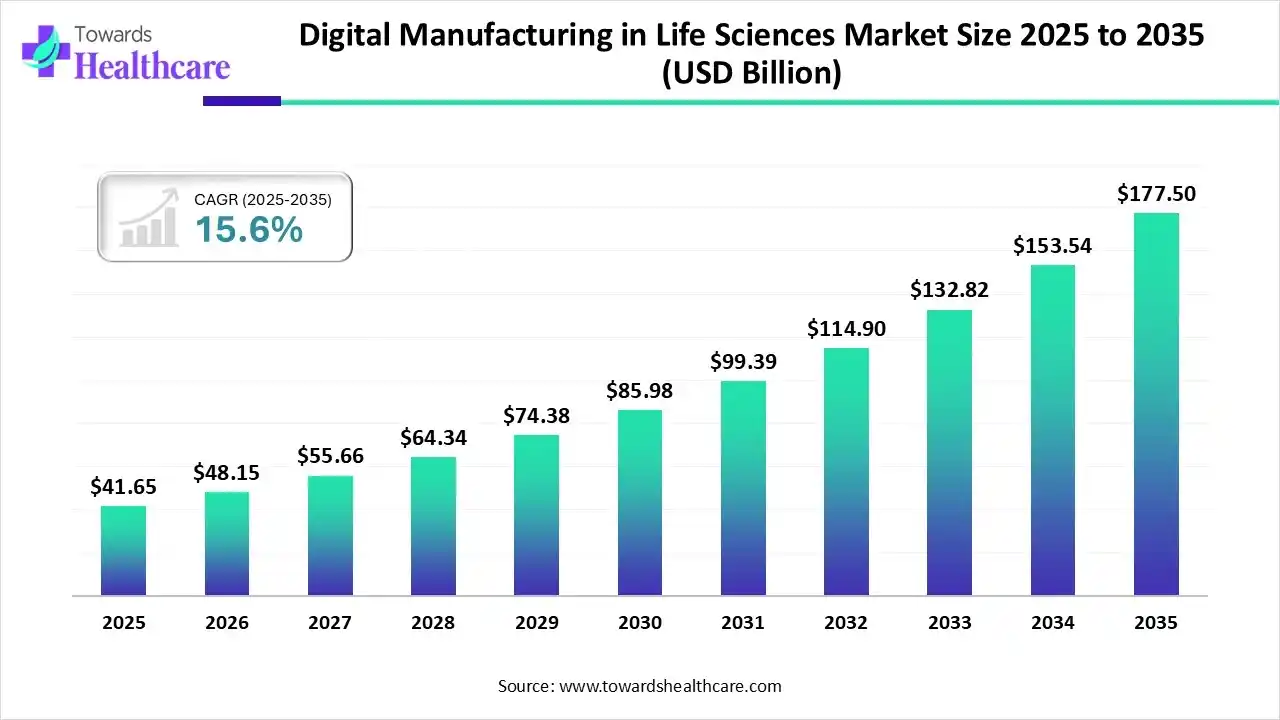

Ottawa, Dec. 19, 2025 (GLOBE NEWSWIRE) -- The global digital manufacturing in life sciences market size is calculated at USD 48.15 billion in 2026 and is expected to reach around USD 177.5 billion by 2035, growing at a CAGR of 15.6% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6444

Key Takeaways

- Digital manufacturing in life sciences sector pushed the market to USD 41.65 billion by 2025.

- Long-term projections show a USD 177.5 billion valuation by 2035.

- Growth is expected at a steady CAGR of 15.6% in between 2026 to 2035.

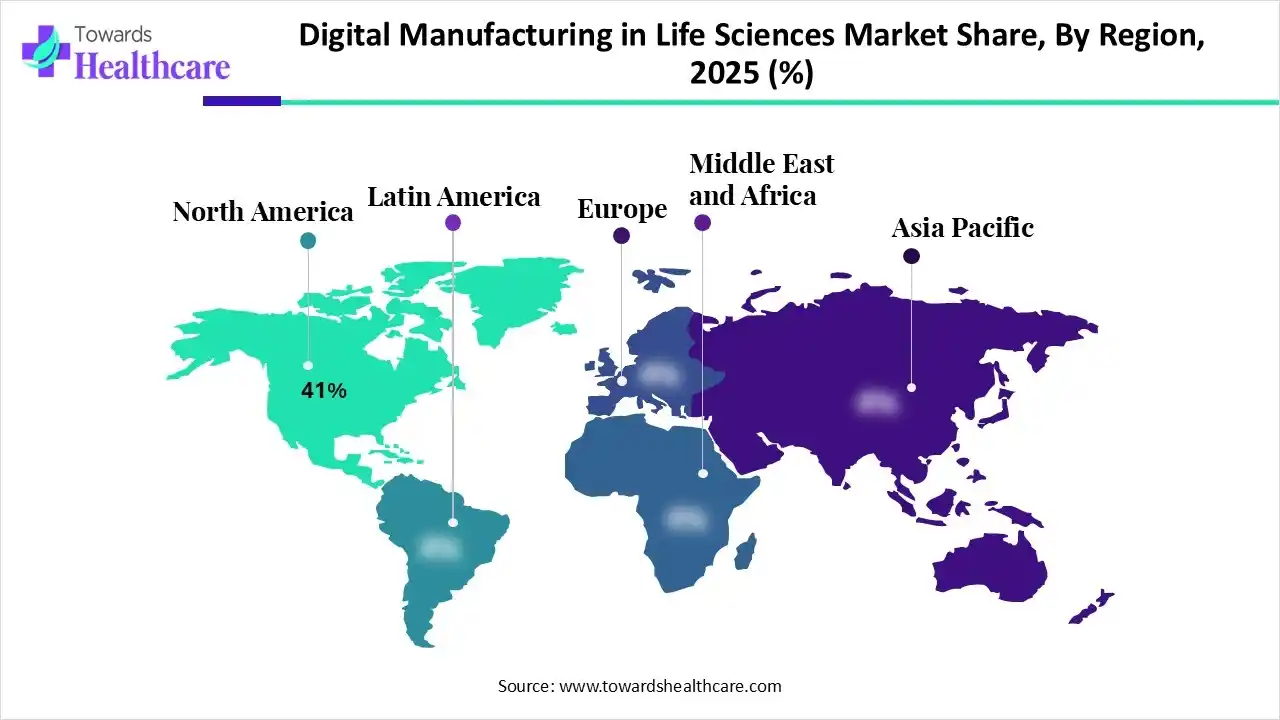

- North America dominated the market by 41% in 2025.

- Asia Pacific is expected to be the fastest-growing region during 2025-2034.

- By solution, the manufacturing execution systems (MES) & process automation segment was dominant in the market in 2024.

- By solution, the AI, ML, and digital twin platforms segment is expected to witness rapid expansion in the coming years.

- By deployment mode, the on-premises segment held a major revenue share of the digital manufacturing in life sciences market in 2024.

- By deployment mode, the public cloud/SaaS segment is expected to grow at a rapid CAGR in the predicted timeframe.

- By end-user, the large pharmaceutical companies segment accounted for the largest share of the market in 2024.

- By end-user, the biotechnology startups segment is expected to grow rapidly during 2025-2034.

What are the Spurring Factors in Digital Manufacturing in Life Sciences?

The global digital manufacturing in life sciences market covers the integration of technologies, especially AI, IoT, and data analytics into drug/biotech production for evolving smart, robust, and compliant operations, which allows real-time monitoring, predictive maintenance, and tailored medicine. This development is primarily propelled by the rising demand for biologics, customised treatments, and also increased adoption of AI, IIoT, and data analytics. Furthermore, diverse firms, such as CPI, are involved in the creation of consortia (with AstraZeneca, AWS, Siemens, etc.) for integrated digital architectures; meanwhile, Honeywell unveiled TrackWise for quality management.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Drivers in the Digital Manufacturing in Life Sciences Market?

A major catalyst is the growing requirement for minimal operation spending during the maintenance of quality through real-time control, predictive maintenance, and automation. However, after COVID-19, there has been a rise in the need for visibility, agility, and collaboration in complex global supply chains, which is also impacting the overall expansion. Whereas, the Manufacturing Execution Systems (MES) support simplifying workflows, accelerating control, and ensuring compliance (paperless systems).

What are the Key Trends in the Digital Manufacturing in Life Sciences Market?

- In November 2025, Iambic raised $100m to transform AI drug discovery platforms.

- In October 2025, Siemens and Capgemini partnered to co-develop AI-native digital solutions for product engineering, manufacturing and operations.

- In March 2025, Körber & HighByte collaborated to assist life sciences manufacturers in elevating the digital transformation of manufacturing in life sciences.

- In October 2024, Life Sciences Innovative Manufacturing Fund (LSIMF) offered a £520 million fund until 2030 for projects in human medicines, medical diagnostics, and MedTech manufacturing.

What is the Emerging Challenge in the Digital Manufacturing in Life Sciences Market?

Companies are facing mainly stringent regulations, greater execution expenditures, data security/privacy, integrating legacy systems, a lack of skilled workforce, and supply chain complexities (visibility, counterfeiting).

Regional Analysis

Why did North America Dominate the Market in 2024?

In 2025, North America captured the biggest revenue share of the market by 41%, due to the accelerating requirement for operational effectiveness, stricter quality control and regulatory compliance, and the growth of precision medicine. The presence pharmaceutical hub is shifting towards digital batch records and electronic documentation, such as MasterControl, which drastically cuts paper use (95%) and fosters batch review (60%), improving compliance (e.g., for FDA).

For instance,

- In September 2025, Apprentice.io, the pioneer of the first AI-enabled manufacturing platform for life sciences, partnered with Aprecia to expand digitally connected drug manufacturing, integrating cutting-edge AI technology with advanced 3DP innovation in drug delivery.

Why did the Asia Pacific Grow Notably in the Market in 2024?

In the digital manufacturing in life sciences market, the Asia Pacific is anticipated to expand rapidly in the coming era. This is primarily fueled by the growing R&D, demand for advanced therapies (biologics), global competitiveness, and strategic investments by China, India, Japan, and Singapore. Day by day, China & Japan are blooming in using robotics for autonomous production in life sciences, with optimized agility and compliance.

For instance,

- In December 2025, ChemLex, a Chinese chemical research start-up, introduced its global headquarters and its unique AI-assisted, fully automated laboratory for drug discovery and development in Singapore’s innovation hub One-North.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

By solution analysis

Which Solution Led the Digital Manufacturing in Life Sciences Market in 2024?

The manufacturing execution systems (MES) & process automation segment captured the dominating share of the digital manufacturing in life sciences market in 2024. Mainly driven by demand for serialization, Electronic Batch Records (EBRs), and lowering labor expenses/shortages. Nowadays, the globe is promoting seamless, building-block MES platforms that adapt to complex needs, including tailored medicine. Recently, Tulip debuted a composable MES for life sciences, focusing on validated workflows and adaptability.

On the other hand, the AI, ML, and digital twin platforms segment is predicted to expand rapidly. Especially, AI and patient digital twins simulate patient responses, particularly in Alzheimer's or G12C KRAS mutation cases, for minimising trial durations and identifying efficient therapies rapidly, bypassing some physical trials. Furthermore, immersive Dassault Systèmes facilitates "Virtual Twin as a Service" for healthcare and life sciences, employs AI for virtual human body twins ("Emma") and improves processes. PapAI/Datategy offers AI layers by integrating with digital twins to provide predictive insights and boost operations across the value chain.

By deployment mode analysis

What Made the On-Premises Segment Dominant in the Market in 2024?

The on-premises segment led with the largest share of the digital manufacturing in life sciences market in 2024. Many life science firms, specifically pharma companies, deal with highly sensitive patient data, R&D, and intellectual property, which makes on-premises a preference for maximum control against breaches. The latest developments include Siemens Xcelerator adoption, FDA support for Process Analytical Tech (PAT), and modular, lean manufacturing cells for devices.

Moreover, the public cloud/SaaS segment is estimated to witness the fastest growth. Their adoption is bolstered by data explosion (AI/ML needs), regulatory compliance, legacy system modernization, expedited time-to-market, and escalated R&D/clinical trial assistance. Currently, advanced solutions comprise GE HealthCare's cloud-first clinical apps (CareIntellect) for better care and Carrier's Lynx FacTOR SaaS for automated pharma cold chain release.

By end-user analysis

How did the Large Pharmaceutical Companies Segment Lead the Market in 2024?

The large pharmaceutical companies segment registered dominance in the market in 2024. Huge players, such as Pfizer, Novartis, AstraZeneca, Roche, and Johnson & Johnson, are increasingly using digitalized solutions, Internet of Things (IoT) sensors and digital twins. Although Roche emphasizes data integration across its diagnostics and pharmaceutical divisions, utilising cloud-based platforms, such as NAVIFY.

Whereas the biotechnology startups segment is predicted to register rapid expansion. The prospective progression is driven by the increasing demand for efficiency, quality, speed (AI/cloud adoption), and tailored medicine (cell/gene therapy). For automating lab workflows, sample handling, and complex tasks, boosting safety and productivity, like CytoTronic’s live cell analysis, are also fostering the adoption. Alongside, Systemic Bio & OminiWell have immensely contributed to the development of platforms for 3D bioprinting and 3D cell cultures.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Recent Developments in the Digital Manufacturing in Life Sciences Market

- In November 2025, Ginkgo Bioworks unveiled the Virtual Cell Pharmacology Initiative (VCPI) through Ginkgo Datapoints, an open-source platform for virtual cell modeling in drug discovery.

- In May 2025, MasterControl launched Master Template Generator at its Masters Conference in Berlin, an innovative AI-driven MasterControl Manufacturing Excellence (Mx) Production Records module.

- In February 2025, EY-Parthenon and Microsoft launched an AI framework for scaling innovation in pharmaceuticals, medtech, and academic research.

Digital Manufacturing in Life Sciences Market Key Players List

- Siemens AG

- Dassault Systèmes

- Rockwell Automation

- Honeywell International

- GE Vernova/GE Digital

- ABB Ltd.

- AspenTech

- Schneider Electric

- AVEVA Group

- SAP SE

- Veeva Systems

- IBM Corporation

- Emerson Electric Co.

- POMSnet (Werum IT Solutions)

- Thermo Fisher Scientific

- Lonza Group AG

- Catalent, Inc.

- Samsung Biologics

- Cytiva (Danaher)

- Amazon Web Services (AWS) Healthcare & Life Science

Browse More Insights of Towards Healthcare:

The global digital mental health platforms market size is calculated at US$ 0.80 billion in 2024, grew to US$ 0.89 billion in 2025, and is projected to reach around US$ 2.49 billion by 2034. The market is expanding at a CAGR of 12.37% between 2025 and 2034.

The global digital psychotherapeutics market size is calculated at US$ 1.69 in 2024, grew to US$ 2.17 billion in 2025, and is projected to reach around US$ 20.66 billion by 2034. The market is expanding at a CAGR of 28.24% between 2025 and 2034.

The global digital health and wellness market size is calculated at US$ 498.99 billion in 2024, grew to US$ 607.06 billion in 2025, and is projected to reach around US$ 3568.11 billion by 2034. The market is expanding at a CAGR of 21.92% between 2025 and 2034.

The global digital brain health market size is calculated at US$ 231.17 billion in 2024, grew to US$ 248.62 billion in 2025, and is projected to reach around US$ 478.53 billion by 2034. The market is expanding at a CAGR of 7.55% between 2025 and 2034.

The digital health tracking app market size is calculated at US$ 16.11 billion in 2024, grew to US$ 18.68 billion in 2025, and is projected to reach around US$ 67.97 billion by 2034. The market is expanding at a CAGR of 15.94% between 2025 and 2034.

The global digital health automation market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034.

The global digital health for obesity market size was estimated at USD 71.60 billion in 2025 and is predicted to increase from USD 87.48 billion in 2026 to approximately USD 530.76 billion by 2035, expanding at a CAGR of 22.18% from 2026 to 2035.

The global digital mental health market size is calculated at US$ 27.84 in 2024, grew to US$ 33.01 billion in 2025, and is projected to reach around US$ 153.03 billion by 2034. The market is expanding at a CAGR of 18.58% between 2025 and 2034.

The global digital dietitian market size is calculated at US$ 1.51 billion in 2024, grew to US$ 1.74 billion in 2025, and is projected to reach around US$ 6.17 billion by 2034. The market is expanding at a CAGR of 15.16% between 2025 and 2034.

The digital mammography market was estimated at US$ 1.53 billion in 2023 and is projected to grow to US$ 4.51 billion by 2034, rising at a compound annual growth rate (CAGR) of 10.30% from 2024 to 2034.

Segments Covered in the Report

By Solution

- Manufacturing Execution Systems (MES) & Process Automation

- Process Analytical Technology (PAT) & Real-Time Monitoring

- Industrial IoT & Edge Connectivity

- AI, ML, and Digital Twin Platforms

- Quality Management Systems (QMS) & eBatch Records

- Cloud Data Platforms & Analytics Hubs

By Application

- Biopharmaceutical Manufacturing

- Small Molecule Drug Manufacturing

- Cell & Gene Therapy

- Vaccine Production

- Diagnostics & Research Labs

By Deployment Mode

- On-premises

- Hybrid Cloud Solutions

- Public Cloud/SaaS

By End User

- Large Pharmaceutical Companies

- Contract Development & Manufacturing Organizations (CDMOs)

- Biotechnology Startups

- Vaccine Manufacturers

- Academic/Translational GMP Facilities

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6444

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest