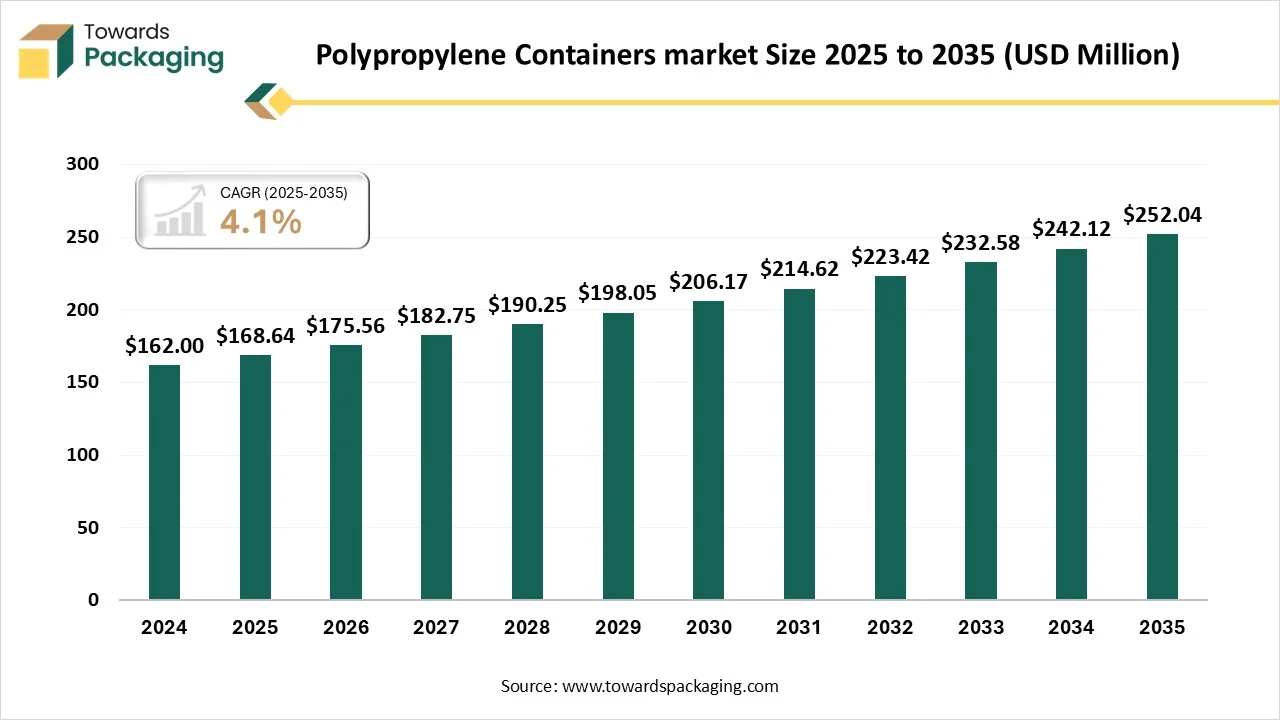

Ottawa, Jan. 26, 2026 (GLOBE NEWSWIRE) -- The global polypropylene containers market generated revenue of USD 168.64 billion in 2025, and this figure is projected to grow to USD 252.04 billion in 2035, according to research conducted by Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by Polypropylene Containers?

Polypropylene containers are packaging products made from polypropylene, a durable, lightweight, and chemically resistant thermoplastic polymer widely used for storing food, beverages, pharmaceuticals, cosmetics, and industrial products. These containers offer excellent heat resistance, moisture barrier properties, and recyclability, making them suitable for both hot and cold applications.

The growth of polypropylene containers is driven by rising demand for safe and hygienic food packaging, increasing use in pharmaceutical and medical packaging, the growth of ready-to-eat and takeaway food consumption, cost-effectiveness compared to alternative materials, and growing preference for reusable and recyclable packaging solutions across consumer and industrial sectors.

Private Industry Investments for Polypropylene Containers:

- Bharat Petroleum Corporation Limited (BPCL) committed ₹5,044 crore to a new polypropylene unit at its Kochi Refinery to meet the growing demand in downstream industries, including packaging.

- Amcor Plc focuses on sustainable packaging innovations, such as the development of an all-polyethylene spouted pouch, and operates over 225 production sites globally to serve various sectors, including food and personal care.

- ALPLA pursues growth through strategic acquisitions and innovations, such as launching a lighter, recyclable PET wine bottle, and is a global leader in custom packaging solutions across 47 countries.

- Pretium Packaging LLC acquired Alpha Consolidated Holdings to boost its capabilities and reinforce its position in specialty food and healthcare markets across North America and Europe.

- Plastipak Holdings, Inc. specializes in rigid plastic packaging and recycled resin production, recently teaming up with Kraft Heinz to shift select containers to 100% recycled PET.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5918

What Are the Latest Key Trends in the Polypropylene Containers Market?

1. Sustainability & Recycled Materials

Manufacturers are increasingly using recycled polypropylene (rPP) and mono-material designs to align with environmental regulations and circular economy goals, reducing waste and carbon footprint while meeting consumer demand for eco-friendly packaging solutions.

2. Smart & Active Packaging Adoption

Innovations such as antimicrobial coatings, QR-coded traceability, and freshness indicators in PP containers enhance food safety, consumer interaction, and product monitoring, especially for perishables and healthcare applications.

3. Advanced Recycling Technologies

New mechanical and chemical recycling methods improve the quality of recycled polypropylene, boosting closed-loop recycling systems and enabling higher use of recycled content without compromising performance.

4. Lightweight & Flexible Packaging

The shift toward lighter and flexible PP container formats meets e-commerce and logistics needs, reducing transportation costs and material use while still providing durability and barrier protection.

5. Bio-based Polypropylene Exploration

Bio-based PP derived from renewable sources like sugarcane ethanol is gaining interest, offering similar properties to traditional PP but with lower environmental impact and better sustainability credentials.

6. Digitalization & Automation Integration

Industry 4.0 technologies, including AI, IoT, and automation, are enhancing PP container production efficiency, quality control, and supply chain responsiveness.

What is the Potential Growth Rate of the Polypropylene Containers Industry?

Polypropylene containers are experiencing strong demand growth due to several key drivers shaping the market landscape. Increasing consumption of packaged food and beverages, driven by urbanization and changing lifestyles, boosts demand for lightweight, durable, moisture-resistant containers. E-commerce expansion further fuels the need for protective, cost-efficient packaging across logistics and retail channels. Stringent sustainability goals and a focus encourage manufacturers to adopt recyclable and mono-material designs that align with circular economy initiatives.

Additionally, expansion in healthcare and pharmaceutical sectors increases the use of PP containers for sterile, chemical-resistant packaging, while ongoing innovation in manufacturing and materials enhances product performance and versatility.

More Insights of Towards Packaging:

- Canned Glass Packaging Market Size and Segments Outlook (2026–2035)

- Alcoholic Beverage Glass Packaging Market Size, Trends and Segments (2026–2035)

- Plastic Turnover Box Market Size, Trends and Regional Analysis (2026–2035)

- Duplex Paper for FMCG Market Size, Trends and Competitive Landscape (2026–2035)

- Recyclable Shrink Film Market Size, Trends and Competitive Landscape (2026–2035)

- Compostable Tray Market Size, Share, Trends, Segments, and Regional Insights (2025-2035)

- Stretch Hooder Packaging Film Market Size and Segments Outlook (2026–2035)

- Pharmaceutical Cold Chain Logistics Packaging Market Size and Segments Outlook (2026–2035)

- Pallet Tanks Market Size, Trends and Regional Analysis (2026–2035)

- Packaging Robots Market Size, Trends and Regional Analysis (2026–2035)

- High-Performance Blown Stretch Film Market Size, Trends and Competitive Landscape (2026–2035)

- L-Sealer Machine Market Size, Trends and Regional Analysis (2026–2035)

- Packaging Coatings Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2026-2035

- Pharmaceutical APET Film Market Size, Trends and Competitive Landscape (2026–2035)

- PET VCI Shrink Film Market Size, Trends and Regional Analysis (2026–2035)

- Electronics APET Film Market Size, Trends and Regional Analysis (2026–2035)

- Specialty Shipping Containers Market Size, Trends and Segments (2026–2035)

- Recycled Aluminum Cans Market Size, Trends and Regional Analysis (2026–2035)

- Plant-Based Food Bioplastics Market Size and Segments Outlook (2026–2035)

- IC Packaging and Testing Market Size and Segments Outlook (2026–2035)

Regional Analysis:

Who is the leader in the Polypropylene Containers Market?

North America dominates the market due to strong demand for lightweight, durable packaging in food, beverage, and consumer goods, supported by advanced manufacturing and recycling infrastructure. Strict sustainability and regulatory frameworks drive recycled polypropylene adoption, while robust e-commerce growth and automotive lightweighting initiatives further reinforce regional leadership and innovation in packaging solutions.

U.S. Polypropylene Containers Market Trends

The U.S. dominates the North American market because it has a well-developed petrochemical and manufacturing infrastructure, ensuring abundant propylene feedstock and advanced processing technologies. A large packaging, automotive, and healthcare industry drives high demand, while strong recycling systems and sustainability initiatives support recycled polypropylene use and innovation, reinforcing U.S. leadership in the region.

How is the Opportunistic is the Rise of the Asia Pacific in the Polypropylene Containers Market?

The Asia-Pacific region is the fastest-growing market for polypropylene containers, driven by rapid economic development, rising disposable incomes, and urbanization. Growing demand for packaged food and beverages, along with the expanding pharmaceutical and healthcare sectors, is significantly increasing the adoption of durable, lightweight, and cost-effective polypropylene container solutions across the region.

China Polypropylene Containers Market Trends

China stands out as the fastest-growing country in the Asia-Pacific market due to its massive manufacturing base, booming e-commerce and food delivery sectors, and rapid urbanization that fuels packaged food demand. Rising disposable incomes and expanding healthcare and pharmaceutical industries further increase polypropylene container use, while strong domestic production capacity and innovation support market expansion.

How Big is the Success of the Europe Polypropylene Containers Industry?

Europe’s market grows at a notable rate because strong demand from the food, beverage, and consumer goods sectors supports PP usage in packaging, while robust recycling and circular-economy initiatives boost recyclable and bio-based PP adoption. Additionally, stringent sustainability regulations and innovation in lightweight, high-performance grades encourage manufacturers to expand polypropylene container applications across industries.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Segment Outlook

Product Type Insights

What made the Rigid Containers Segment Dominant in the Polypropylene Containers Market in 2025?

The rigid containers segment leads the market due to its compatibility with automated filling lines, tamper-evident designs, and long shelf-life requirements. Their ability to maintain shape under pressure, support premium branding, and comply with strict food-contact and pharmaceutical standards makes them a preferred choice for large-scale commercial applications.

The flexible container segment is growing rapidly due to its material efficiency, lower transportation costs, and adaptability to modern retail formats. These containers support space-saving designs, high-speed packaging, and on-the-go consumption trends, making them well-suited for evolving consumer preferences and sustainability-focused packaging strategies.

Deployment Type / Packaging Format Insights

How the Bulk Containers Dominated the Polypropylene Containers Market in 2025?

The bulk containers segment dominates the market due to its efficiency in storing and transporting large volumes of liquids, chemicals, and food products. Its durability, resistance to corrosion, and ability to maintain product integrity make it highly preferred by industries. Additionally, ease of handling, stackability, and cost-effectiveness further drive its widespread adoption across various sectors.

The retail/consumer containers segment is the fastest-growing in the market due to rising demand for convenient, lightweight, and durable packaging for food, beverages, and household products. Increasing e-commerce, growing awareness of hygienic and reusable packaging, and the preference for visually appealing designs that enhance brand visibility are also driving rapid adoption in this segment.

Application Insights

Which Factors Make the Food & Beverage Segment the Dominant Segment in the Market in 2025?

The food & beverage segment dominates the market due to the material’s excellent chemical resistance, lightweight nature, and durability, which ensure safe storage and extended shelf life. Rising demand for packaged and ready-to-eat foods, along with growing consumer preference for hygienic, leak-proof, and microwave-safe containers, further strengthens this segment’s leadership.

The personal care & cosmetics segment leads growth in polypropylene containers due to rising consumer demand for sustainable, recyclable packaging, strong aesthetics and design flexibility, chemical stability with formulations, suitability for premium branding, and increasing e‑commerce and hygiene requirements that drive innovative, lightweight, and visually appealing container solutions.

Technology Insights

What made the Standard Polypropylene Segment Dominant in the Polypropylene Containers Market in 2025?

The standard polypropylene segment dominates the market due to its cost-effectiveness, versatility, and ease of processing. Its excellent chemical resistance, durability, and lightweight nature make it ideal for a wide range of applications, from food storage to personal care packaging, driving widespread adoption across industries.

The co‑polymer polypropylene segment grows fastest in the market because copolymer grades offer improved impact strength, flexibility, and durability compared with homopolymers, especially at low temperatures. These enhanced mechanical and processing properties make them ideal for diverse container applications requiring toughness, clarity, and reliability in packaging.

Distribution Channel Insights

How did Direct Sales to Manufacturers Dominate the Polypropylene Containers Market in 2024?

The direct sales to manufacturers segment dominates the market because it enables cost savings, bulk pricing, and stronger B2B relationships, while offering customized shapes, sizes, and specifications to industrial buyers. This channel also ensures reliable supply continuity and better technical support tailored to the manufacturer's needs.

The online/digital platform segment is the fastest‑growing in the market due to expanding e‑commerce and B2B marketplaces that offer wide product selection, convenience, and tailored solutions. Growth is driven by rising internet penetration, digital purchasing preferences, efficient logistics and order fulfillment, and the ability to reach global customers cost‑effectively.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Recent Breakthroughs in the Polypropylene Containers Industry

- In January 2026, LCY company, a company supplying polypropylene and manufacturer, and Milliken & Company, a multifaceted international manufacturer, have teamed up to launch 737U, a new high-performance polypropylene grade improved with Milliken's DeltaMax 5000a additive technology. Paint containers, automobile parts, furniture, outdoor equipment, and high-weight-loading containers are among the applications for which 737U is intended for injection molding.

- In October 2025, Braskem S.A, a petrochemical company, presented a new range of circular and bio-based product solutions at the world's premier plastics and rubber trade show in Düsseldorf, Germany, to quicken the plastics industry's transformation. This included collaborations with Eurobottle and Bottle Up, two Dutch brands. One example of this was the collaboration with the German company Polytan.

Top Companies in the Global Polypropylene Containers Market & Their Offerings:

- Pokaro: Produces food-grade, injection-molded rectangular and round containers designed for durability and temperature resistance.

- Amcor plc.: Offers a vast range of rigid containers, tubs, and pots primarily for the food and healthcare industries.

- Sealed Air Corporation: Focuses on high-barrier rigid trays and specialized bottles designed for food safety and extended shelf life.

- Huhtamaki: Provides thin-wall PP containers and trays for dairy and food-to-go services, emphasizing lightweight and recyclable designs.

- Alpla Group: Manufactures high-precision blow-molded bottles and injection-molded closures for beverages, home care, and pharmaceuticals.

- Berry Global Group: Supplies a massive catalog of rigid containers and lids, often featuring advanced tamper-evident and moisture-barrier features.

- Mondi Group: Specializes in PP-based technical films and rigid solutions optimized for industrial and food-service protection.

- Coveris: Focuses on high-performance rigid containers and trays that utilize advanced barrier technology to preserve freshness.

- Graham Packaging: Produces custom-engineered rigid bottles and containers specifically for the food, beverage, and automotive sectors.

- Gerresheimer AG: Manufactures specialized, high-purity PP containers and medical bottles that meet strict global pharmaceutical standards.

Segment Covered in the Report

By Product Type

- Rigid Containers

- Jars

- Bottles

- Flexible Containers

- Pouches

- Sachets

- Closure Systems & Caps

- Specialty Containers

- Dispensing Containers

- Multi-compartment Containers

- Ancillary Packaging Accessories

- Labels

- Seals

By Deployment Type / Packaging Format

- Bulk Containers:

- Retail/Consumer Containers:

- Industrial Containers

By Application

- Food & Beverages

- Pharmaceuticals & Healthcare

- Personal Care & Cosmetics

- Chemicals & Industrial Products

- Others

By Technology / Material Type

- Standard Polypropylene

- Copolymer Polypropylene

- Specialty / Modified PP

By Distribution Channel

- Direct Sales to Manufacturers

- Distributors & Resellers

- Online / Digital Platforms

- Retail & E-commerce

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5918

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

- VCI Anti-corrosion Film Market Size and Segments Outlook (2026–2035)

- Molded Tableware Products Market Size and Segments Outlook (2026–2035)

- Duplex Paper and Board for FMCG Market Size, Trends and Regional Analysis (2026–2035)

- Tablet Inspection and Printing System Market Size, Trends and Competitive Landscape (2026–2035)

- Plastic Tray Market Size and Segments Outlook (2026–2035)

- IV Fluid Bags Market Size and Segments Outlook (2026–2035)

- Automated E-Commerce Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Reverse Tuck Box Market Size and Segments Outlook (2026–2035)

- Recycled Polyethene for Sustainable Flexible Packaging Market Size, Trends and Segments (2026–2035)

- Barrier Coating for Recyclable Flexible Packaging Market Size, Trends and Segments (2026–2035)

- Polycarbonate Sheet Market Trends and Global Production Volumes for 2026-2035

- Biodegradable Plastic Films Market Strategic Growth, Innovation & Investment Trends 2026-2035

- Certified-Circular Polyethylene (PE) Market Size and Segments Outlook (2026–2035)

- High-Quality Rigid Packaging Materials Market Size, Trends and Regional Analysis (2026–2035)

- Molded Pulp Packaging Market Size, Trends, Segments, Regional Outlook & Competitive Landscape Analysis